Overview

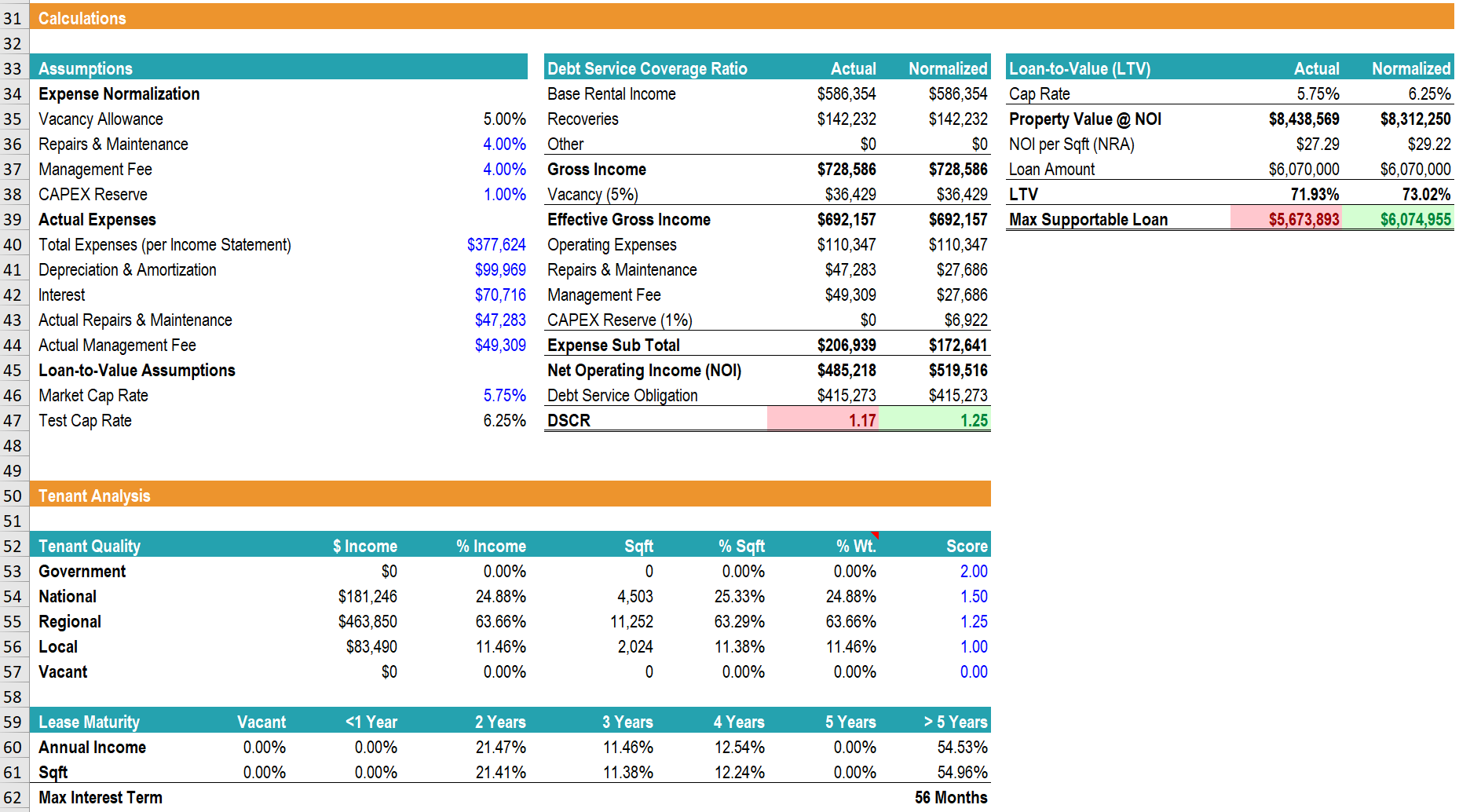

You will review the components of the due diligence package, including documents such as a Purchase & Sale Agreement, an Offer to Lease, a rent roll, a restricted-use appraisal report, and the vendor’s historical financial statements. We’ll also work through some assessment tools to support your analysis of the credit request, including a rent roll summary, a commercial mortgage calculator, and a risk rating and profitability model.

You will review the components of the due diligence package, including documents such as a Purchase & Sale Agreement, an Offer to Lease, a rent roll, a restricted-use appraisal report, and the vendor’s historical financial statements. We’ll also work through some assessment tools to support your analysis of the credit request, including a rent roll summary, a commercial mortgage calculator, and a risk rating and profitability model.

Recommended Prerequisites

We recommend you complete the following courses before taking this practice lab:

Who Should Take This Practice Lab?

This practice lab is perfect for any aspiring credit analyst working in real estate, underwriting, commercial lending, corporate credit analysis, and other areas of credit evaluation.Rocky Mountain Holdings Ltd. - Commercial Mortgage Learning Objectives

- Step into the role of a credit analyst

- Review components of the due diligence package

- Analyze documents such as Purchase & Sale Agreement, Offer to Lease, rent roll, restricted-use appraisal report, and historical financial statements

- Utilize assessment tools for credit request analysis

- Summarize rent roll information

- Use a commercial mortgage calculator

- Apply a risk rating and profitability model

Prerequisite Courses

Recommended courses to complete before taking this course.

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

- Basic Math

Level 4

57min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Transaction Analysis

Case Study Summary

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending

Commercial Real Estate Finance Specialization

- Skills Learned Real Estate Lending, Real Estate Financial Modeling, Construction Finance, Environmental Analysis and Due Diligence, Lease and Rent Roll Analysis

- Career Prep Credit Analysts, Risk Manager & Credit Adjudicator, Private Real Estate Lenders, Real Estate Investors and Advisors, Commercial Mortgage Brokers, Commercial Relationship Managers