Overview

Retail, Restaurant, & Franchise Lending Course Overview

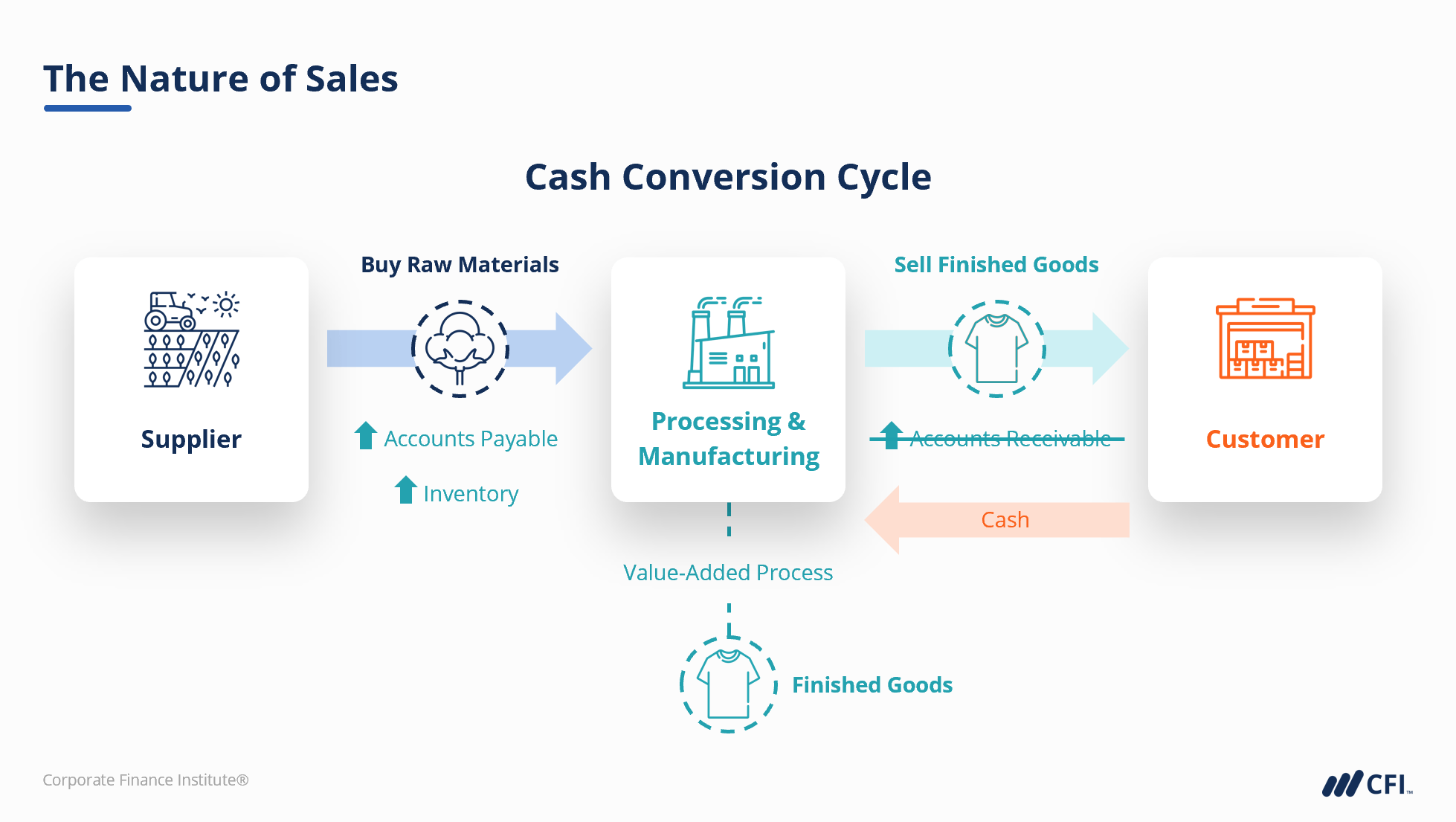

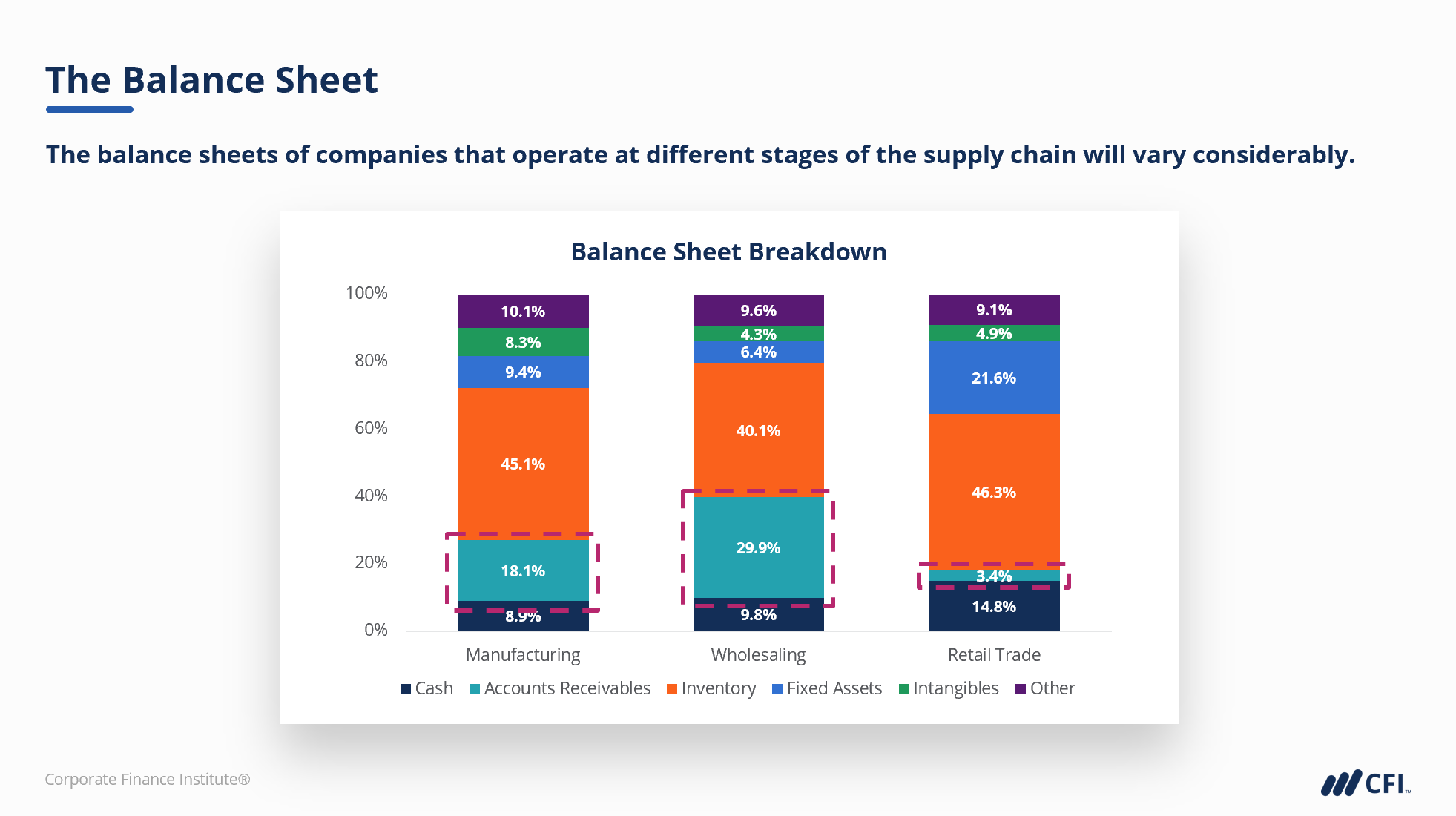

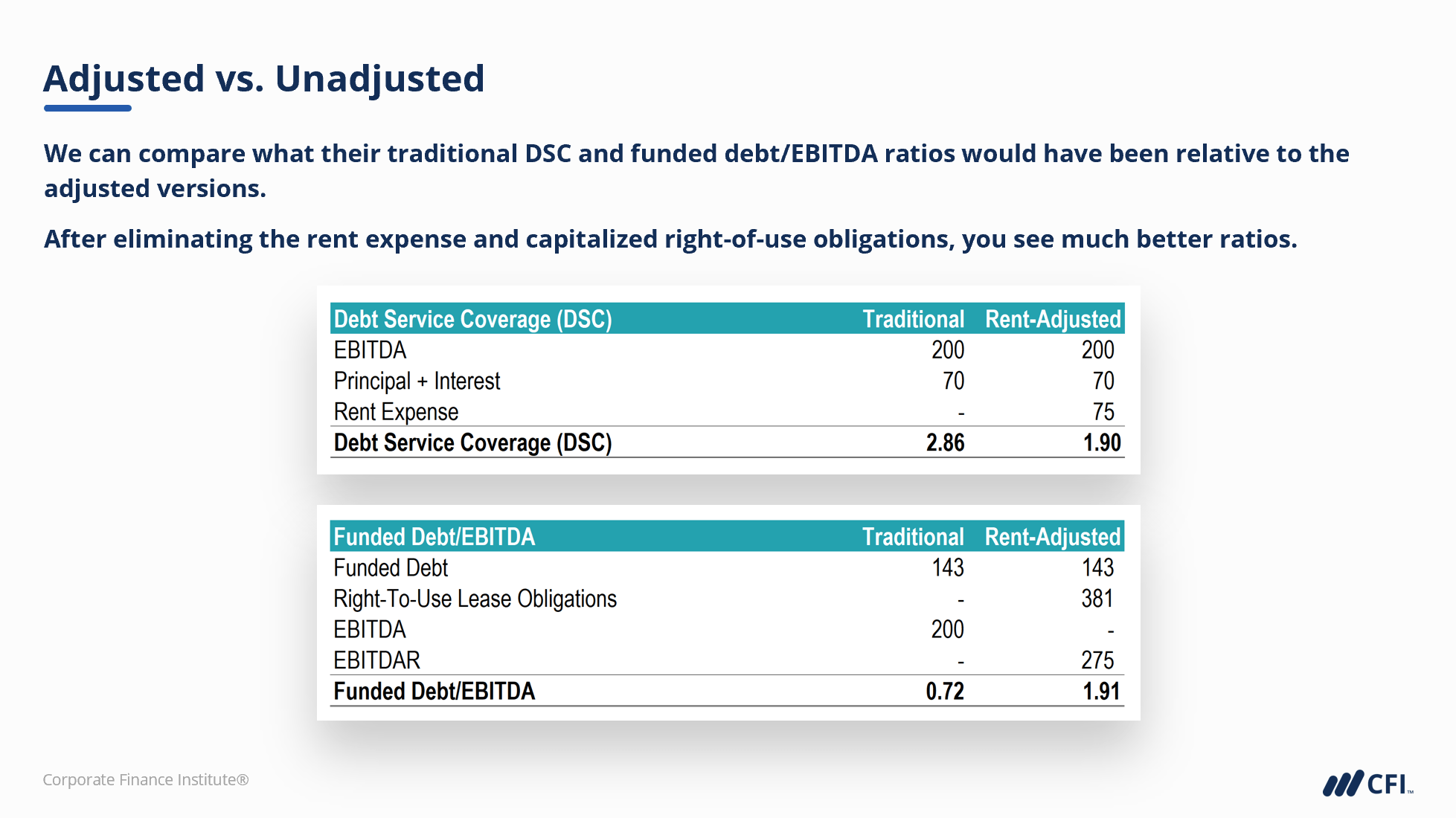

This course examines the details necessary for assessing a loan for retail companies, restaurants, and franchise businesses. These businesses differ from traditional commercial borrowers and other supply chain companies. Unlike wholesalers or manufacturers, retailers and restaurants generally require high rent and occupancy costs to succeed, among other factors. This course will show you how to identify these factors and adjust for them to enable you to assess a loan for these prospective borrowers. At the end of this course, we will examine a case study using a real-world scenario.

Who should take this course?

This course is designed for current and aspiring commercial banking professionals and credit analysts. Retail, restaurant, and franchise clients are just one category among many borrowers that a commercial banker or credit analyst will encounter. This course will prepare you with the knowledge to assess a loan for these businesses properly.

Retail, Restaurant, & Franchise Lending Learning Objectives

- Compare retail trade and food-service businesses to more traditional commercial banking clients across other parts of the supply chain

- Identify important characteristics that inform the level of credit risk associated with any given operator

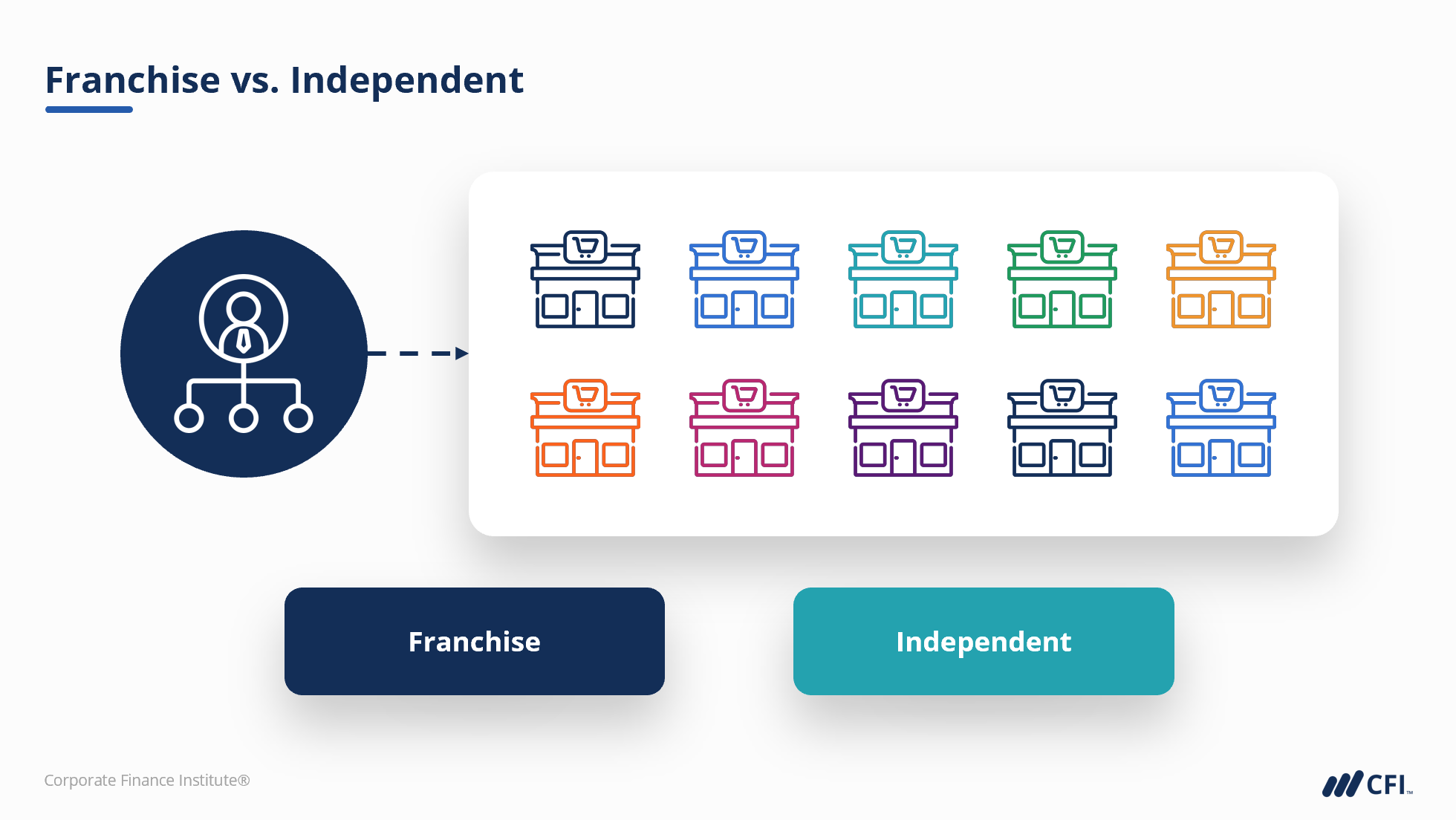

- Explain what makes food-service businesses unique, as well as how franchise brands can help mitigate some industry risk

- Calculate adjusted lending ratios and interpret the differences between these and more traditional credit metrics

Prerequisite Courses

Recommended courses to complete before taking this course.

Level 3

1h 45min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Differentiating Factors

Restaurants & Food Service

Mid-Way Check-in

Quantitative & Ratio Analysis

Conclusion

Qualified Assessments

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending