Overview

Reading Business Financial Information Overview

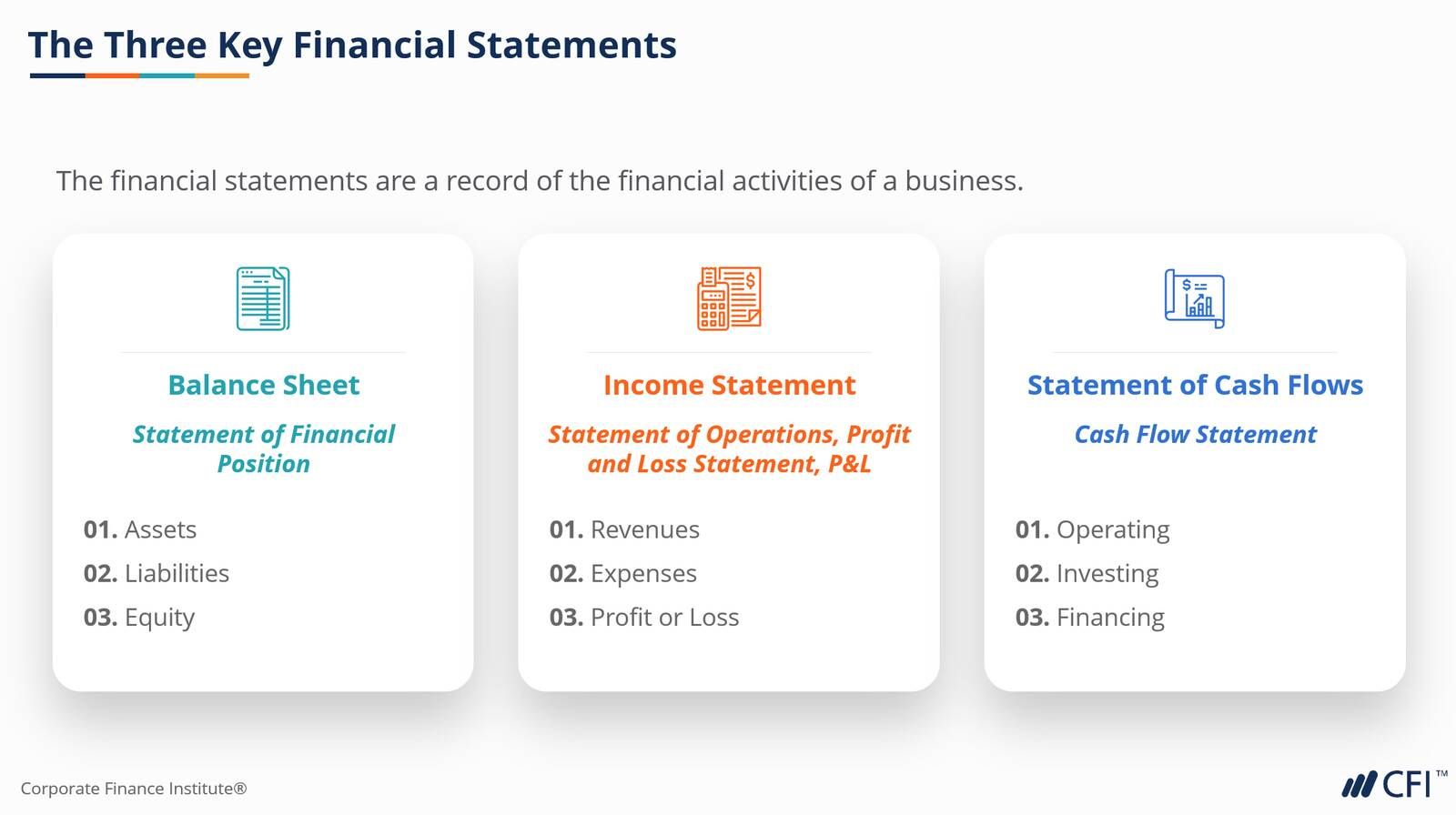

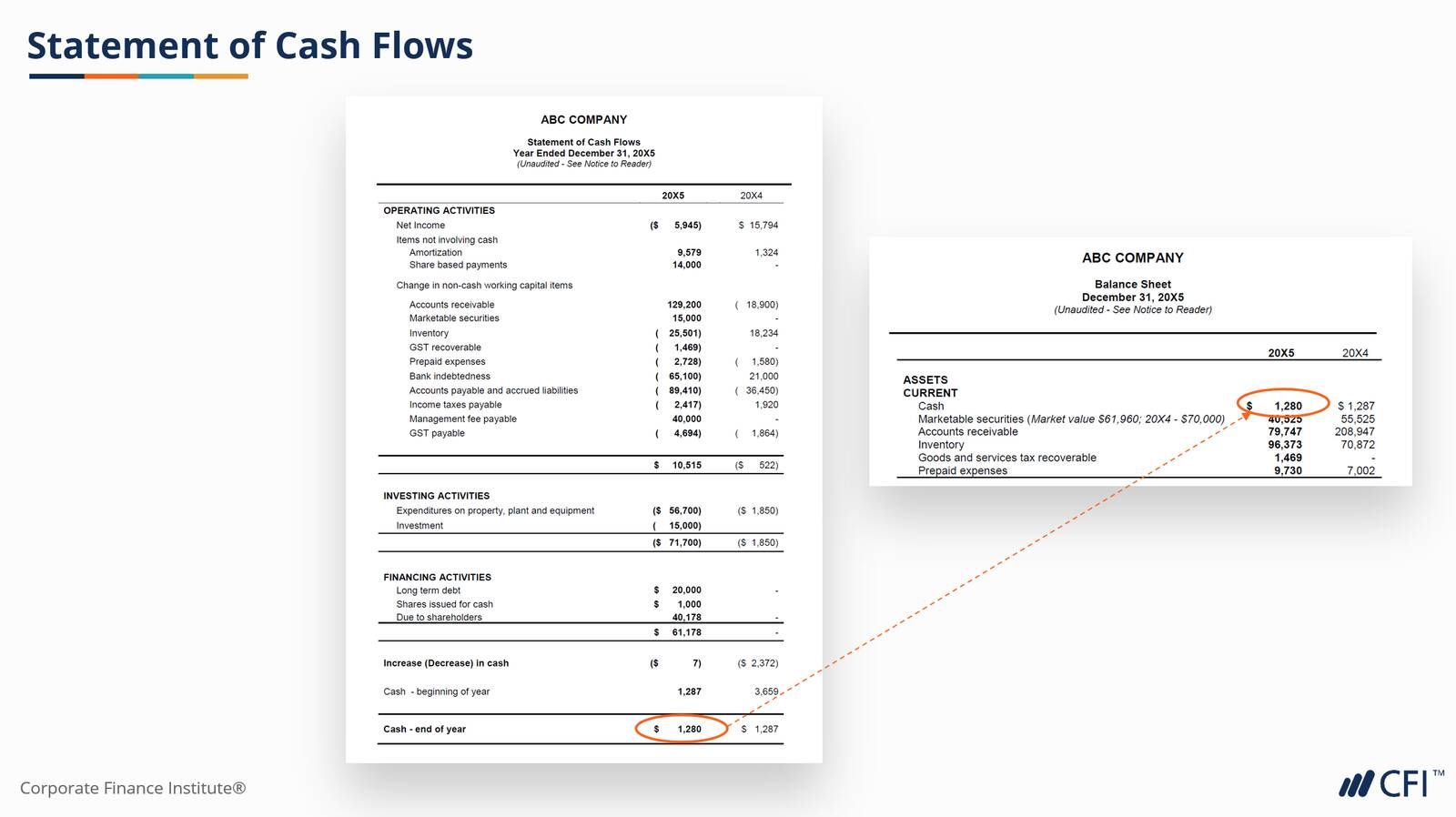

Reading business financial information is a critical task of every credit analyst and the first step in reviewing a credit application. In this Reading Business Financial Information course, we will look at key financial statements including the balance sheet, income statement, and the statement of cash flows. We’ll explore the relationship between these financial statements and how they are linked to each other. We’ll also look at the different levels of accountant’s reports and the comfort each provides. We will further consider what’s included in the business tax return and how to use this information. Finally, we’ll calculate and interpret the key credit-related ratios for assessing the financial capacity of a business. All these contribute to the business story and influence the credit decisions to be made.

We will further consider what’s included in the business tax return and how to use this information. Finally, we’ll calculate and interpret the key credit-related ratios for assessing the financial capacity of a business. All these contribute to the business story and influence the credit decisions to be made.

Who should take this course?

This Reading Business Financial Information course is perfect for any aspiring credit analysts working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation.Reading Business Financial Information Learning Objectives

- Understand the basics of the three main financial statements and key financial terms

- Learn the different components of financial statements

- Understand how the three financial statements link together

- Differentiate the levels of accountant’s reports and the comfort each provides

- Calculate and interpret the key lending ratios

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

Level 2

1h 36min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Introduction

Reading the Balance Sheet and Statement of Equity

Reading the Income Statement and Statement of Cash Flows

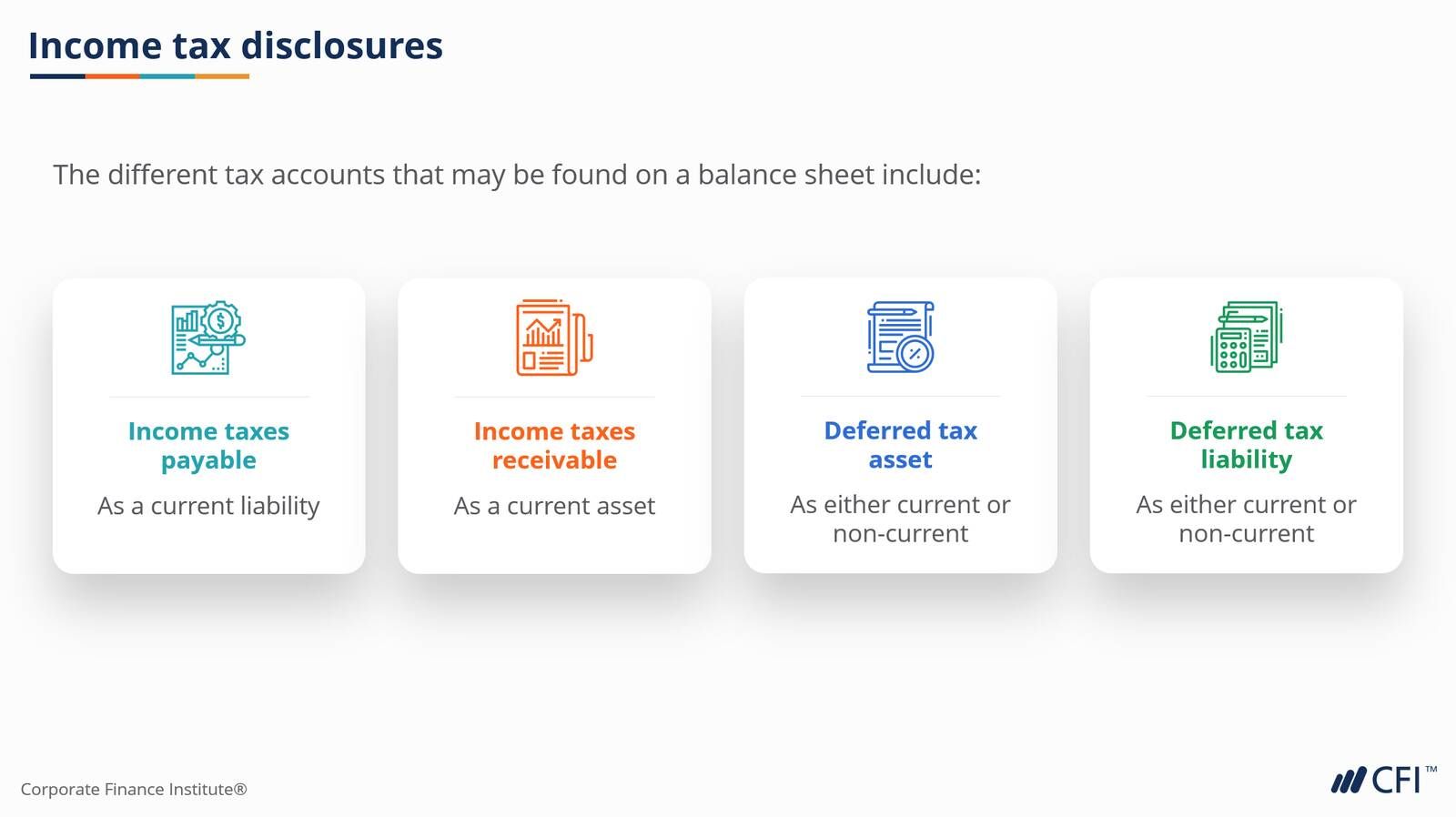

Taxation

Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending