Overview

Construction Loan-in-process Course Overview

This construction loan-in-process course focuses on construction lending, primarily from a bank’s point of view. It is the third and final course in the three-part series and should be taken after Construction Finance Fundamentals and Structuring a Construction Loan. This course discusses the payment cycle, how holdback or retainage clauses are applied, and various legal tools related to construction payments. Later in the course, we will discuss the loan monitor’s role, change order and contingencies, what to do when the project fails, and briefly describe title insurance.

Who should take this course?

This course was created for current and aspiring professionals working in commercial banking roles, focusing on the real estate development industry. It is also useful for anyone exploring the intricacies of construction lending. Taught from the lender’s perspective, this course provides a solid foundation of the lending process for construction development loans and would also provide key takeaways for mortgage brokers and related industry advisors.

Construction Loan-in-Process Learning Objectives

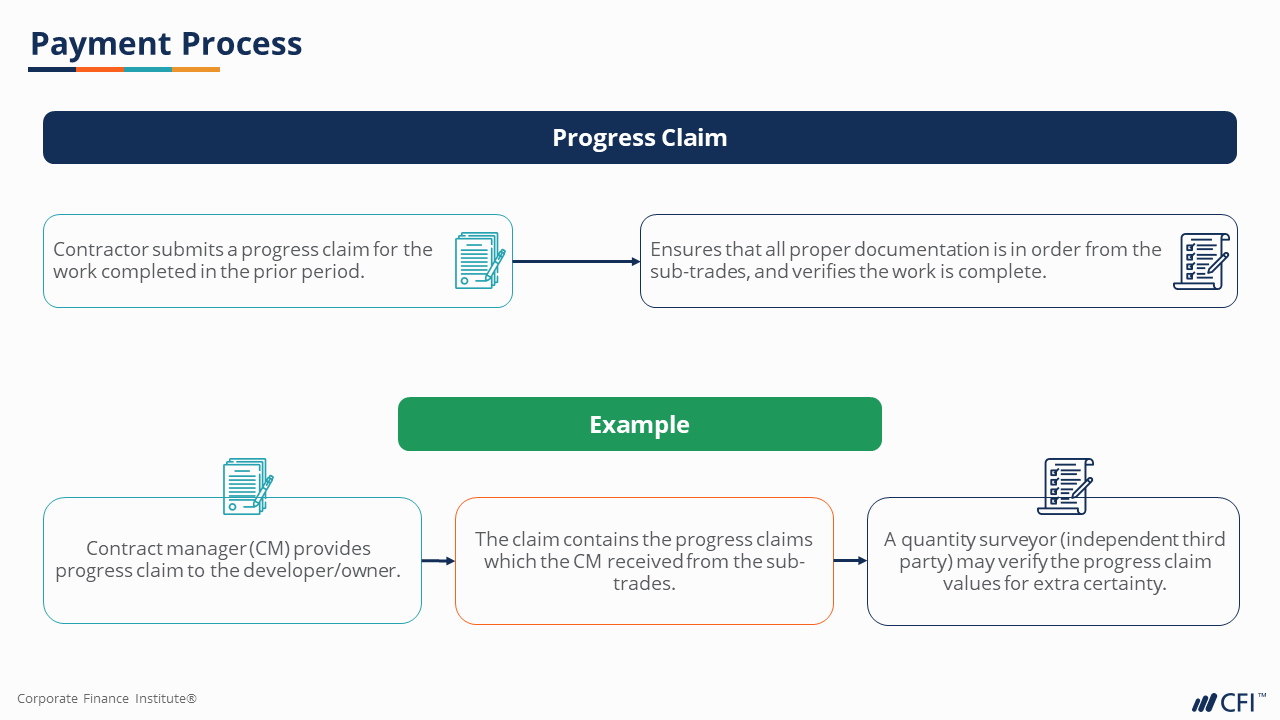

- Understand the construction payment cycle and process

- Explain how holdbacks or retainage are applied and why

- Grasp legal tools related to construction payments such as liens, statutory declarations, and prompt payment legislation

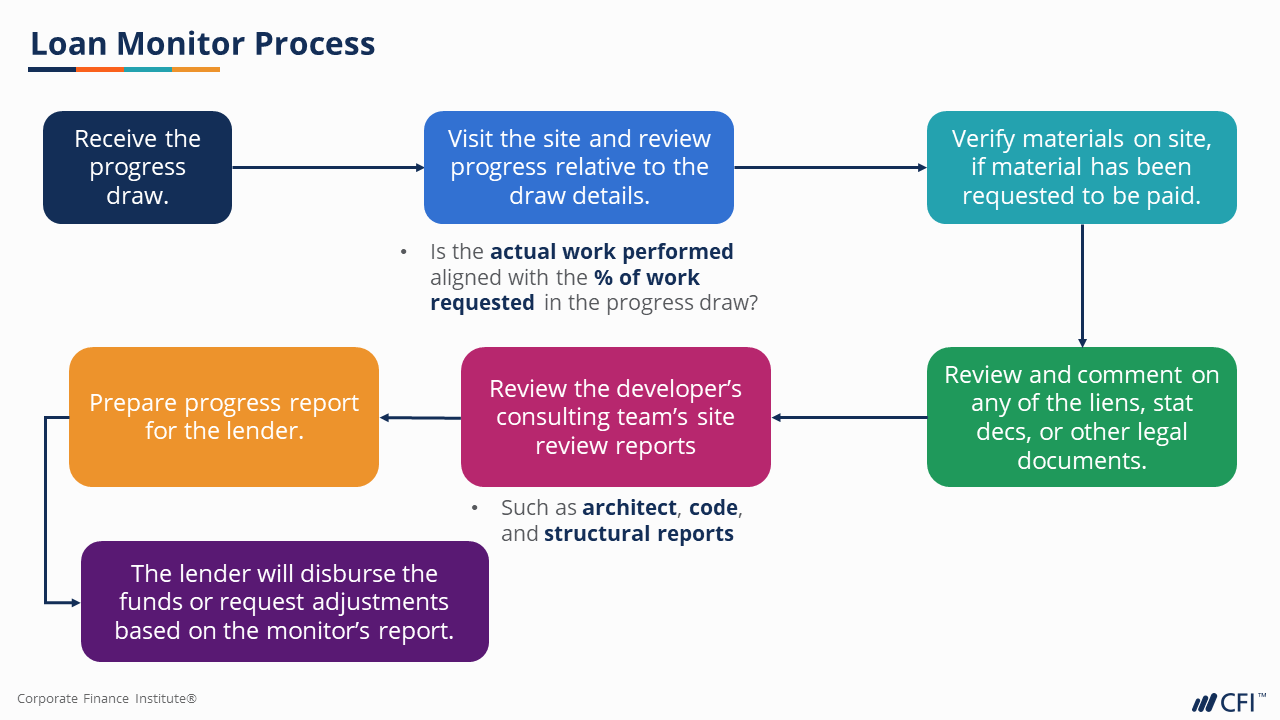

- Appreciate the loan monitor’s role in payment processing and loan disbursements

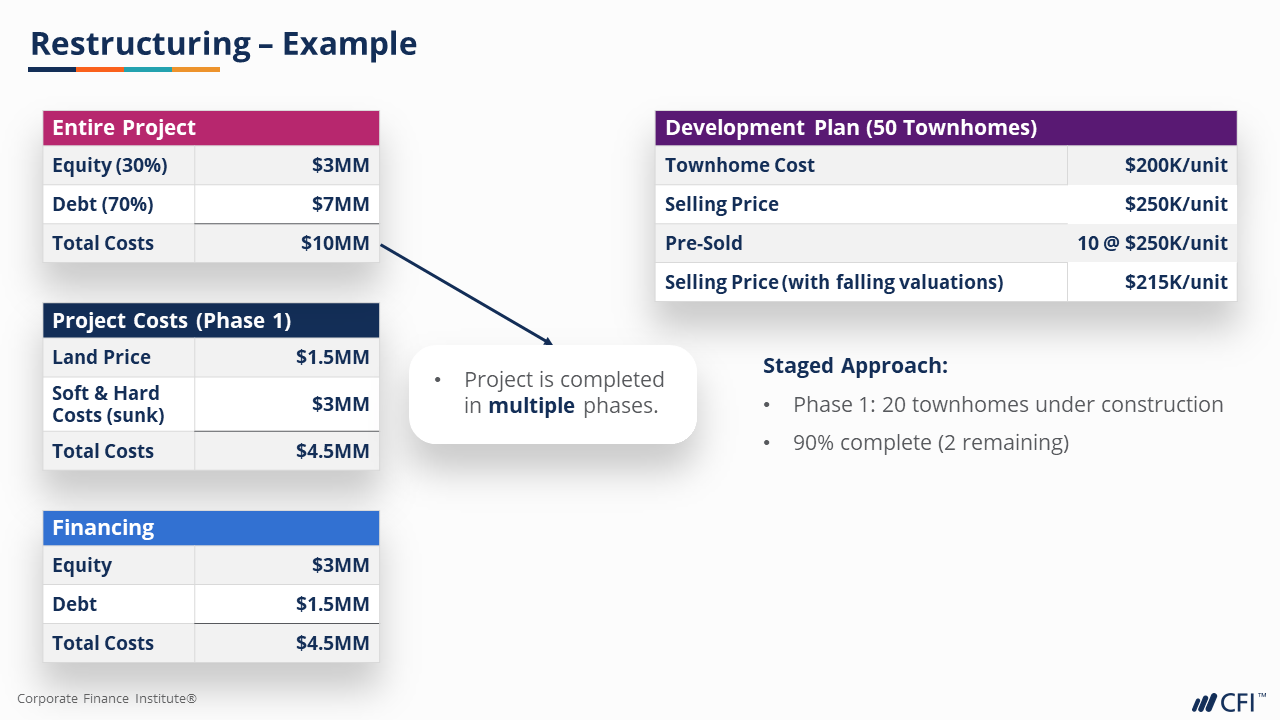

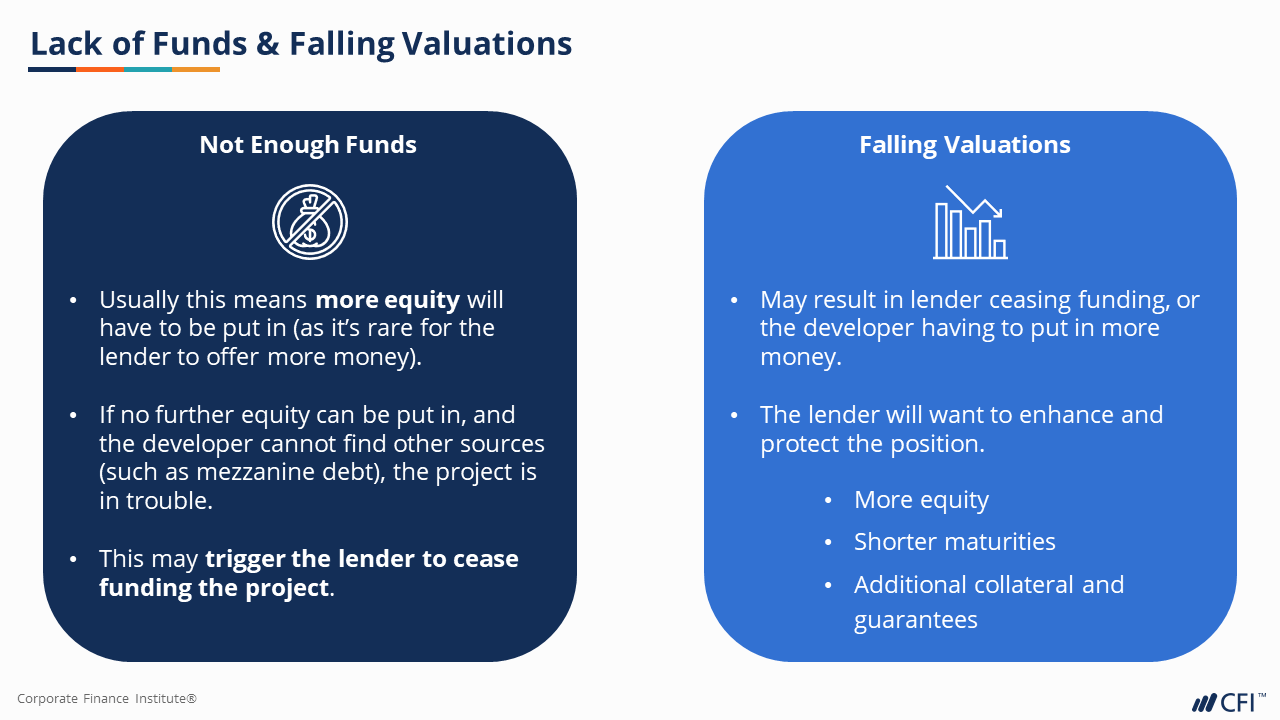

- Address strategies and processes for non-performing loans

- Understand title insurance and why it’s important

Prerequisite Courses

Recommended courses to complete before taking this course.

Level 3

42min

100% online and self-paced

Field of Study: Specialized Knowledge

Start LearningWhat You'll Learn

Course Introduction

Other Payment Concepts

Change Orders & Contingency

Title Insurance

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Real Estate Finance Specialization

- Skills Learned Real Estate Lending, Real Estate Financial Modeling, Construction Finance, Environmental Analysis and Due Diligence, Lease and Rent Roll Analysis

- Career Prep Credit Analysts, Risk Manager & Credit Adjudicator, Private Real Estate Lenders, Real Estate Investors and Advisors, Commercial Mortgage Brokers, Commercial Relationship Managers