Overview

Loan Covenants Course Overview

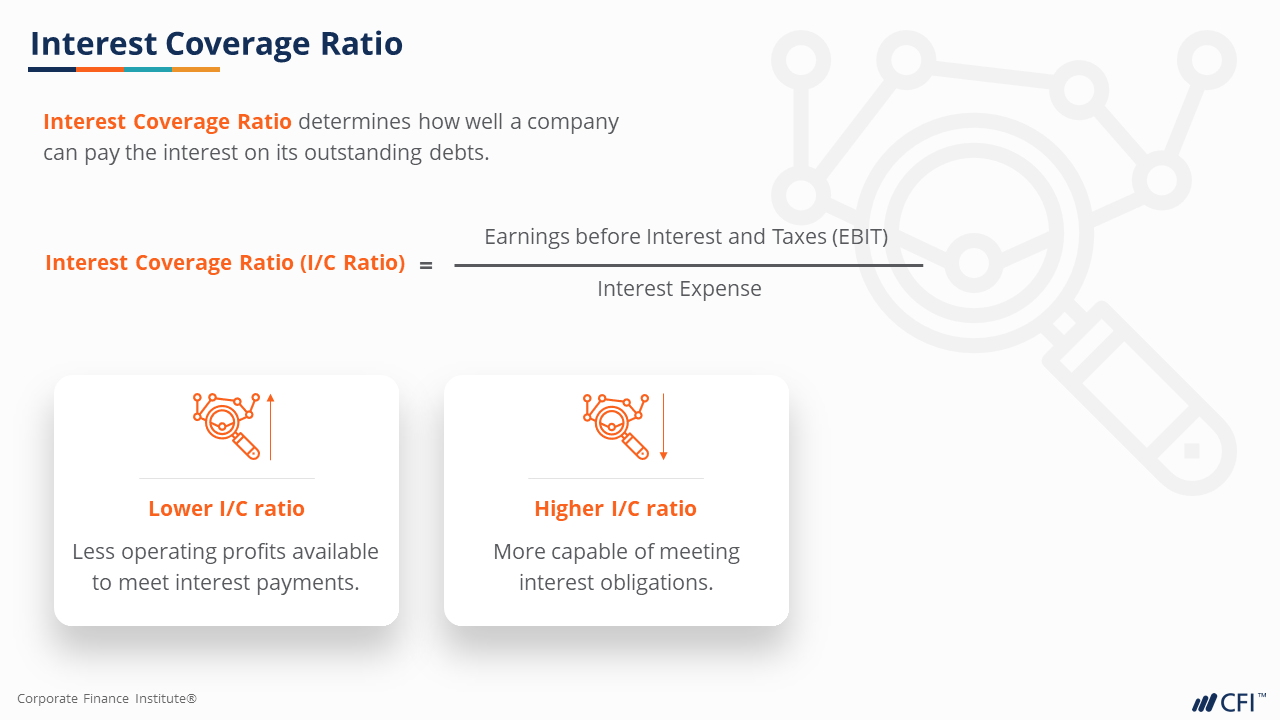

In this Loan Covenants course, we will demonstrate how loan covenants are used in the lending process. We will start this course by defining covenants and discussing how they benefit both the lender and the borrower. We will then compare different covenants and discuss what a credit analyst should do in case of a covenant breach. After that, we will discuss key financial covenant ratios such as total liabilities to equity ratio (debt-to-equity), debt service coverage ratio (DSCR), working capital ratio, and debt to EBITDA ratio. We will explain what these ratios are, how to calculate them, and how they are used in evaluating a company’s creditworthiness.

After that, we will discuss key financial covenant ratios such as total liabilities to equity ratio (debt-to-equity), debt service coverage ratio (DSCR), working capital ratio, and debt to EBITDA ratio. We will explain what these ratios are, how to calculate them, and how they are used in evaluating a company’s creditworthiness.

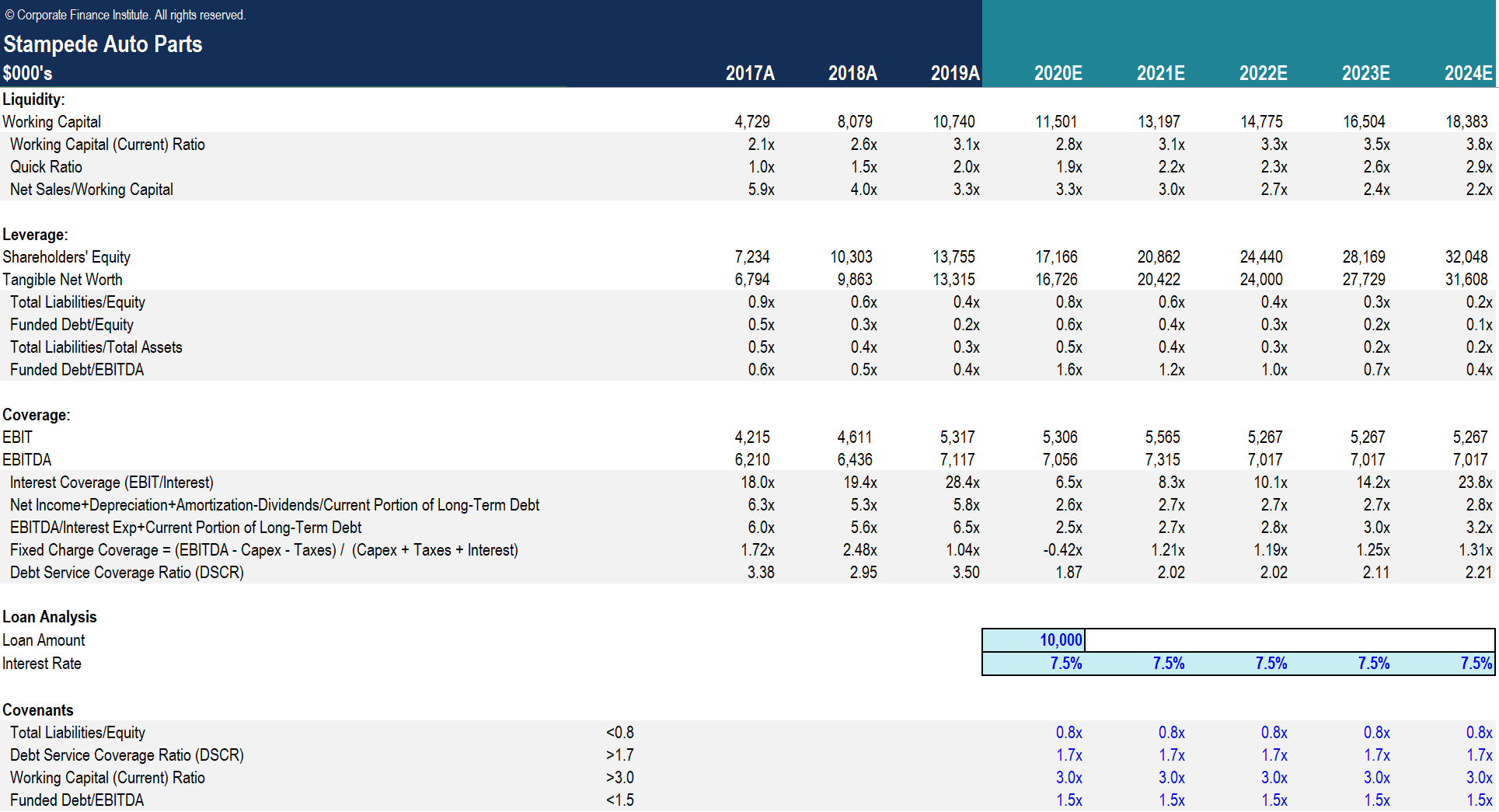

Finally, we will complete a case study where you need to build a covenant model in Excel. We will calculate a company’s key credit metrics based on the historical and forecast financial statements. We will compare these metrics to the covenants that are set for this business and are suitable for the loan.

Finally, we will complete a case study where you need to build a covenant model in Excel. We will calculate a company’s key credit metrics based on the historical and forecast financial statements. We will compare these metrics to the covenants that are set for this business and are suitable for the loan.

Who should take this course?

This Loan Covenants course is perfect for any aspiring credit analyst working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation.Loan Covenants Learning Objectives

- Understand the key concepts of covenants in a loan agreement

- Explain different types of loan covenants

- Calculate key financial covenant metrics

- Use a financial model in Excel to model financial covenants

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Financial accounting

- Basic Math

Level 3

1h 16min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Common Covenant Metrics

Loan Covenants Case Study

Conclusion

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending