Overview

Fixed Income Fundamentals Course Overview

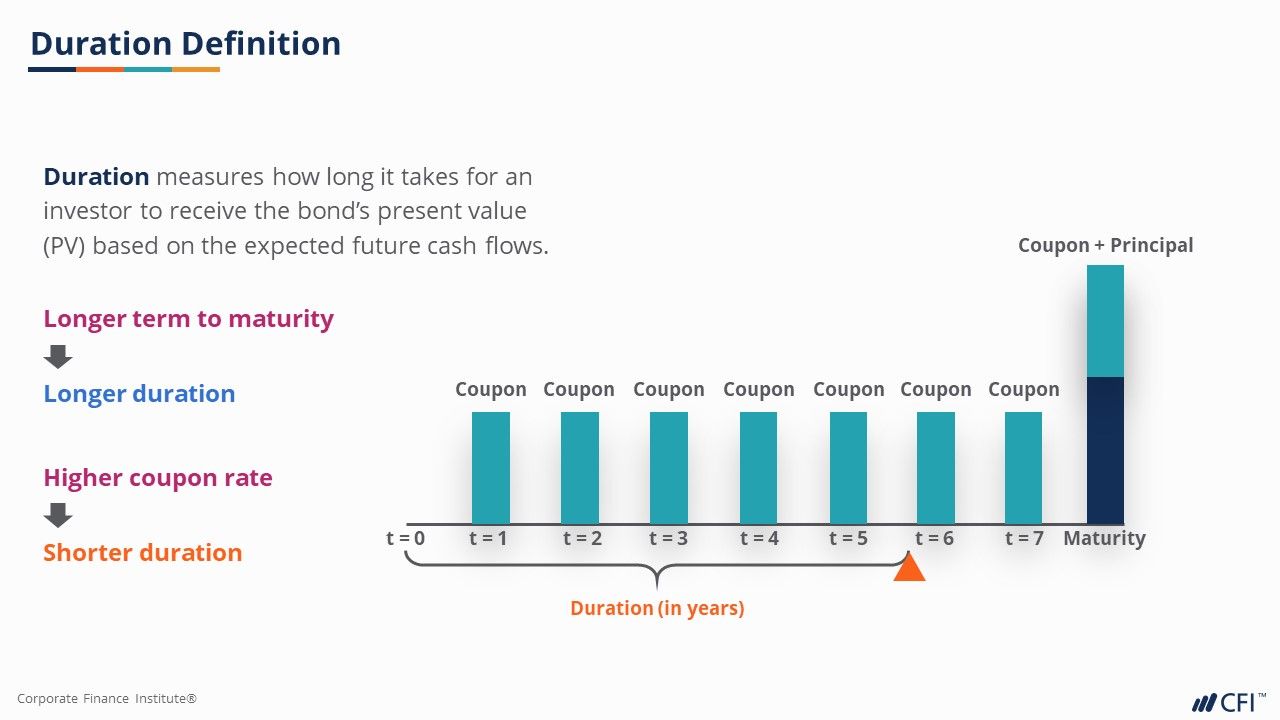

In this Fixed Income Fundamentals course, we will explore the basic products and players in fixed income markets. We will introduce key bond features such as par value, coupon, yield curves, and credit spreads. Then, we will calculate the price of a bond using discounted cash flows and the relationship between a bond’s price and its yield. Clean prices, dirty prices, accrued interest, and day count are other fixed income topics discussed in this online course. Finally, we will explore bond risk measures, including Macaulay duration, modified duration, dollar duration, and convexity. We will then calculate the price sensitivity to yield changes using these risk measures.

Who Should Take This Course?

This Fixed Income Fundamentals course is perfect for anyone who wants to build up their understanding of capital markets. This course is designed to equip anyone who desires to begin a career in fixed income, equity, sales and trading, or other areas of finance with the fundamental knowledge of fixed income.Fixed Income Fundamentals Learning Objectives

- Define the key concepts of the basic fixed income instrument – bonds

- Explain who buys bonds, who issues bonds, and the bond market

- Examine the concepts of yield, coupon, and day count

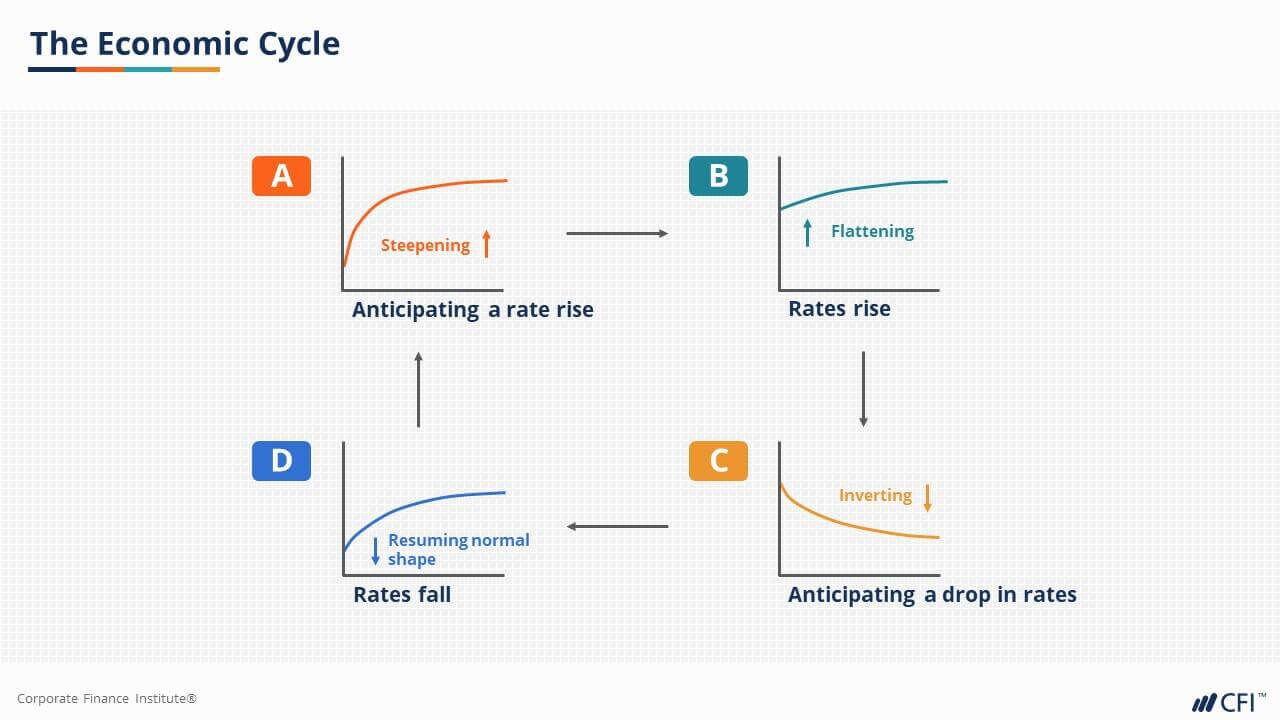

- Discuss the yield curve, credit spreads, and what they represent

- Calculate the price of a bond and explain the relationship between price and yield

- Measure the yield sensitivity of a bond by using duration and convexity

Prerequisite Courses

Recommended courses to complete before taking this course.

Level 3

1h 36min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Fixed Income Overview

Coupon and Yield

Bond Risk Measures

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side

Financial Planning & Wealth Management Professional (FPWMP®) Certification

- Skills Learned Financial Learning, Business Development, Investment Management, Practice Management, Relationship Management

- Career Prep Financial Planner, Investment Advisor, Portfolio Manager

Risk Management Specialization

- Skills You’ll Gain Risk Identification, Regulatory Analysis, Risk Measurement, Risk Mitigation

- Great For: Market Risk Analyst, Credit Risk Analyst, Compliance Officer, consulting, Enterprise Risk Manager, Audit