Overview

Interest Rate Swap Fundamentals Course

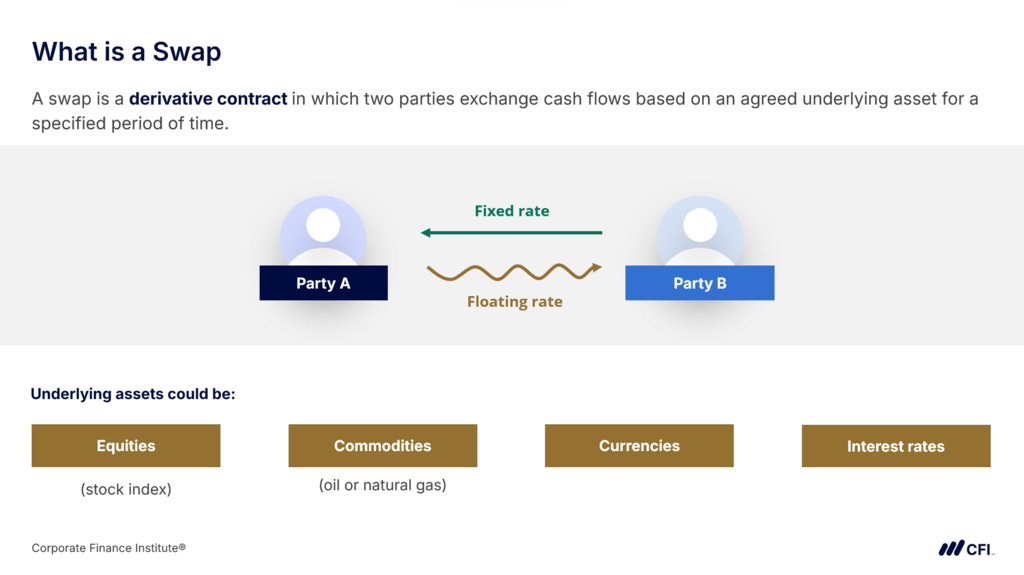

Interest rate swaps are one of the most widely used derivatives in global finance, helping institutions manage exposure to changing interest rates and align assets with liabilities. Understanding how swaps work is essential for professionals in corporate finance, investment management, and risk management.

This course explains the transition from LIBOR to alternative reference rates (ARRs) such as SOFR, €STR, and SONIA, and explores why these benchmarks matter. You will learn the structure, terminology, and purposes of interest rate swaps, including the difference between payer and receiver swaps. The course also covers how to value swaps using forward rate curves, cash flow projections, and net present value techniques. Finally, you will build a step-by-step Excel model of a SOFR swap, applying day count conventions and discounting methods to understand real-world applications of swap pricing and risk management.

Who Should Take This Course?

This course is designed for anyone looking to understand how interest rate swaps work and why they matter in modern finance. It is especially useful for professionals in corporate finance, treasury, investment management, and risk management who want to strengthen their knowledge of derivatives and hedging strategies.

Interest Rate Swap Fundamentals Learning Objectives

By the end of this course, learners will be able to:

- Explain the transition from LIBOR to alternative reference rates and classify the key ARRs by their characteristics.

- Describe the structure, terminology, and purposes of interest rate swaps, and differentiate between payer and receiver swaps.

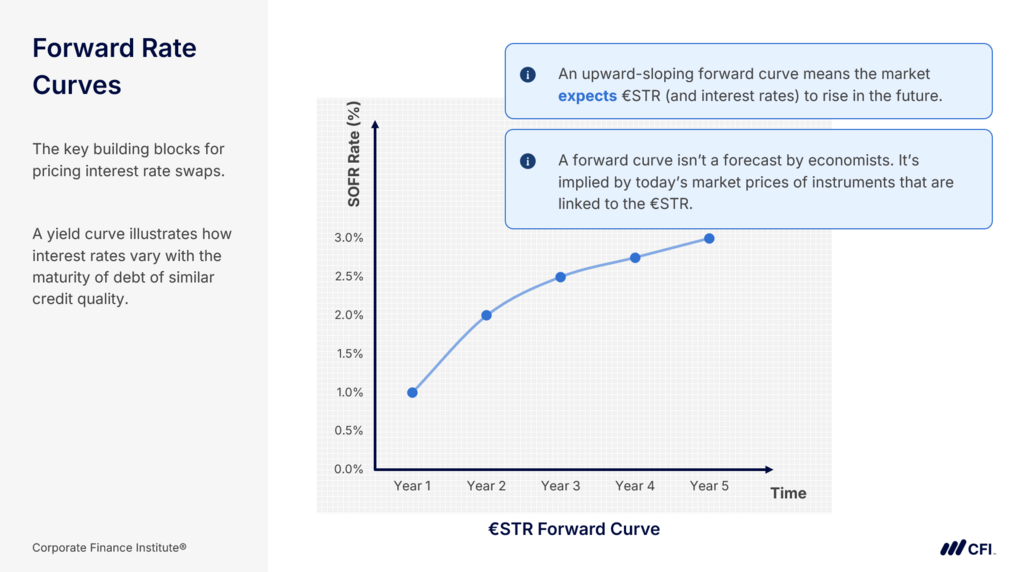

- Apply forward rate curves and valuation techniques to calculate fixed and floating cash flows and the net present value of an interest rate swap.

- Construct an Excel model of a 5-year SOFR swap by implementing day count conventions, projecting cash flows, and discounting to present value.

- Explain and compute the mechanics of centrally cleared interest rate swaps, including variation margin, coupon payments, price alignment interest (PAI), and initial margin.

Prerequisite Courses

Recommended courses to complete before taking this course.

Level 3

1h 34min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Pricing A Swap

The Centrally Cleared IRS Market

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side