Overview

Fundamentals of Credit Course Overview

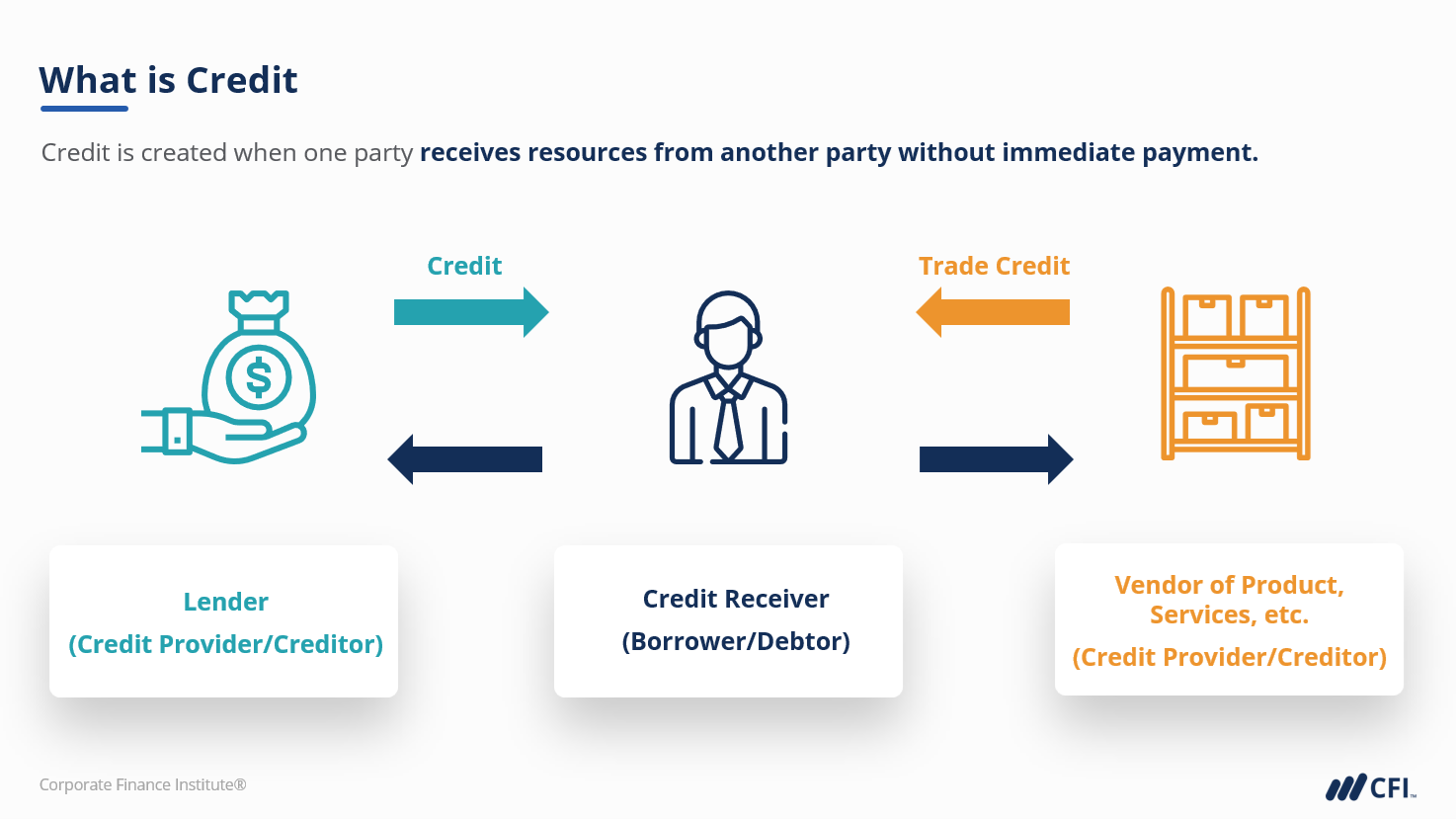

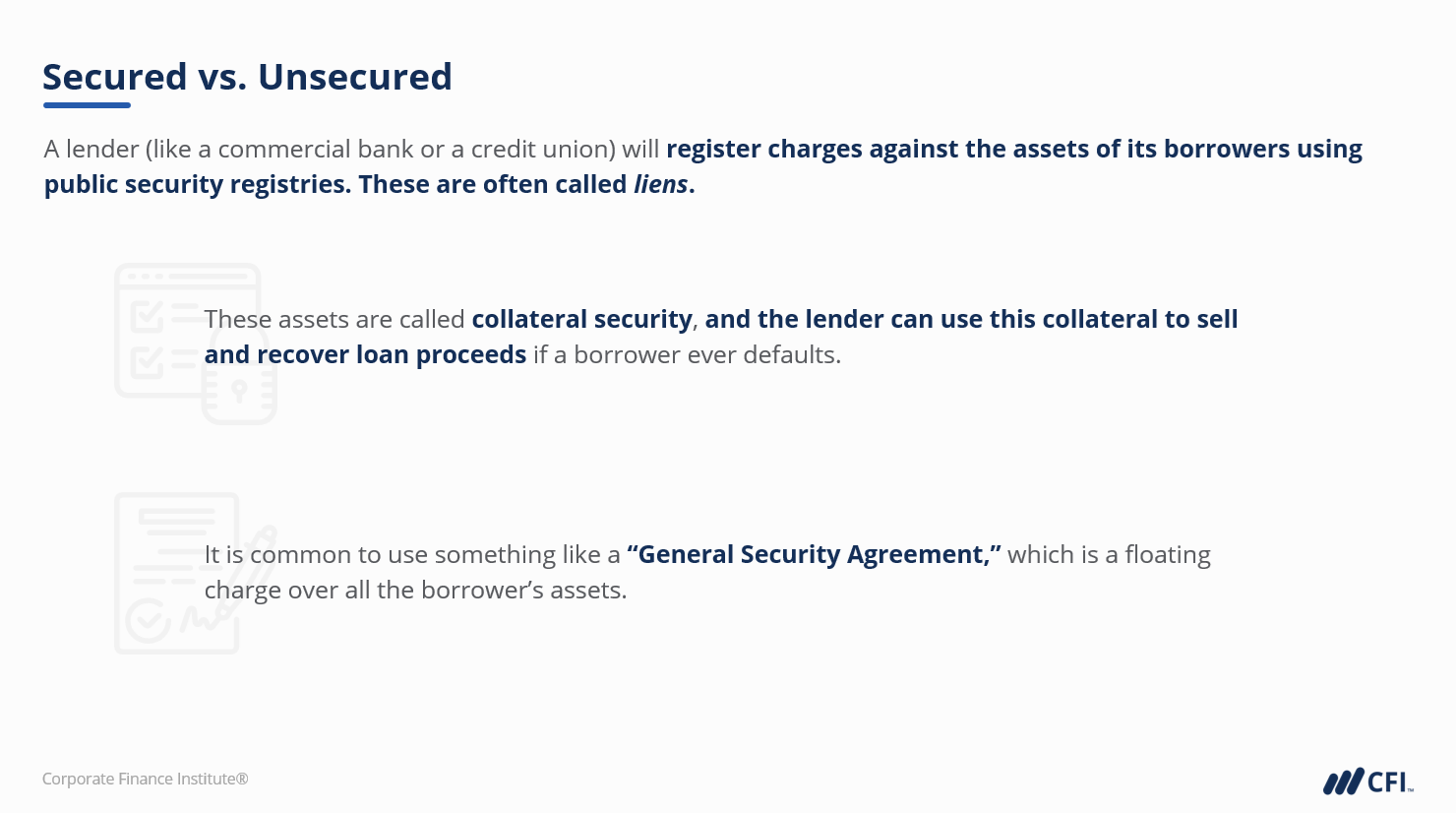

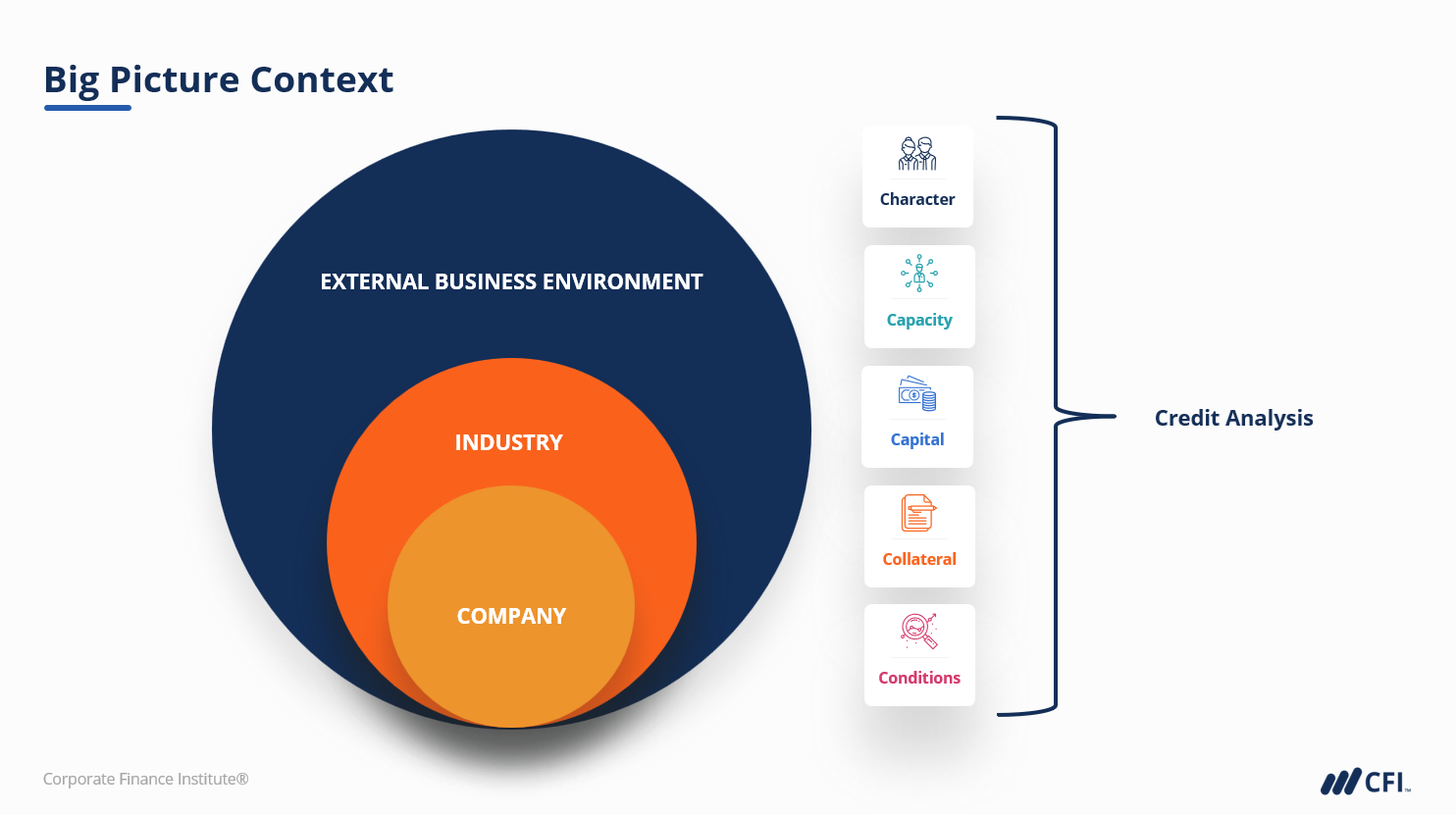

Credit plays an important role in the lives of many individuals; it’s also a key source of funding for businesses making capital expenditures (CAPEX). In this course, we discuss important lending topics like the difference between traditional loans and trade credit, different types of interest, different types of loans, where collateral security fits in, and how to build an amortization schedule for reducing term debt. We cover an overview of the 5 Cs of Credit framework and how it may influence different loan characteristics before diving into some qualitative assessment tools and a list of the key financial ratios that an analyst would look at when evaluating a company’s creditworthiness. We also take a step back to look at the credit landscape to help learners understand what kinds of career opportunities exist for aspiring credit professionals.

Who should take this course?

This Fundamentals of Credit course is perfect for any aspiring or early-stage credit professionals, including business and commercial bankers, credit analysts, real estate lenders, equipment finance, loan & mortgage brokers, and other private (non-bank) lenders.

Fundamentals of Credit Learning Objectives

- Define what credit is and how it’s created

- Identify some of the different career opportunities available to credit professionals

- Compare different types of interest payments and loan characteristics to help inform an appropriate credit structure

- Explain what capital expenditure (or CAPEX) is and how debt financing can support it

- Explain the 5 Cs of Credit framework and how it informs risk assessments

- Identify the important qualitative and quantitative techniques, including key financial ratios used in the risk assessment process

Prerequisite Skills

Recommended skills to have before taking this course.

- Logical thinking

Level 1

1h 14min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Types and Features of Credit

Midway Check-In

The Credit Process & Analysis Fundamentals

Conclusion

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending

Risk Management Specialization

- Skills You’ll Gain Risk Identification, Regulatory Analysis, Risk Measurement, Risk Mitigation

- Great For: Market Risk Analyst, Credit Risk Analyst, Compliance Officer, consulting, Enterprise Risk Manager, Audit