Overview

Commercial Banking – Debt Modeling Course Overview

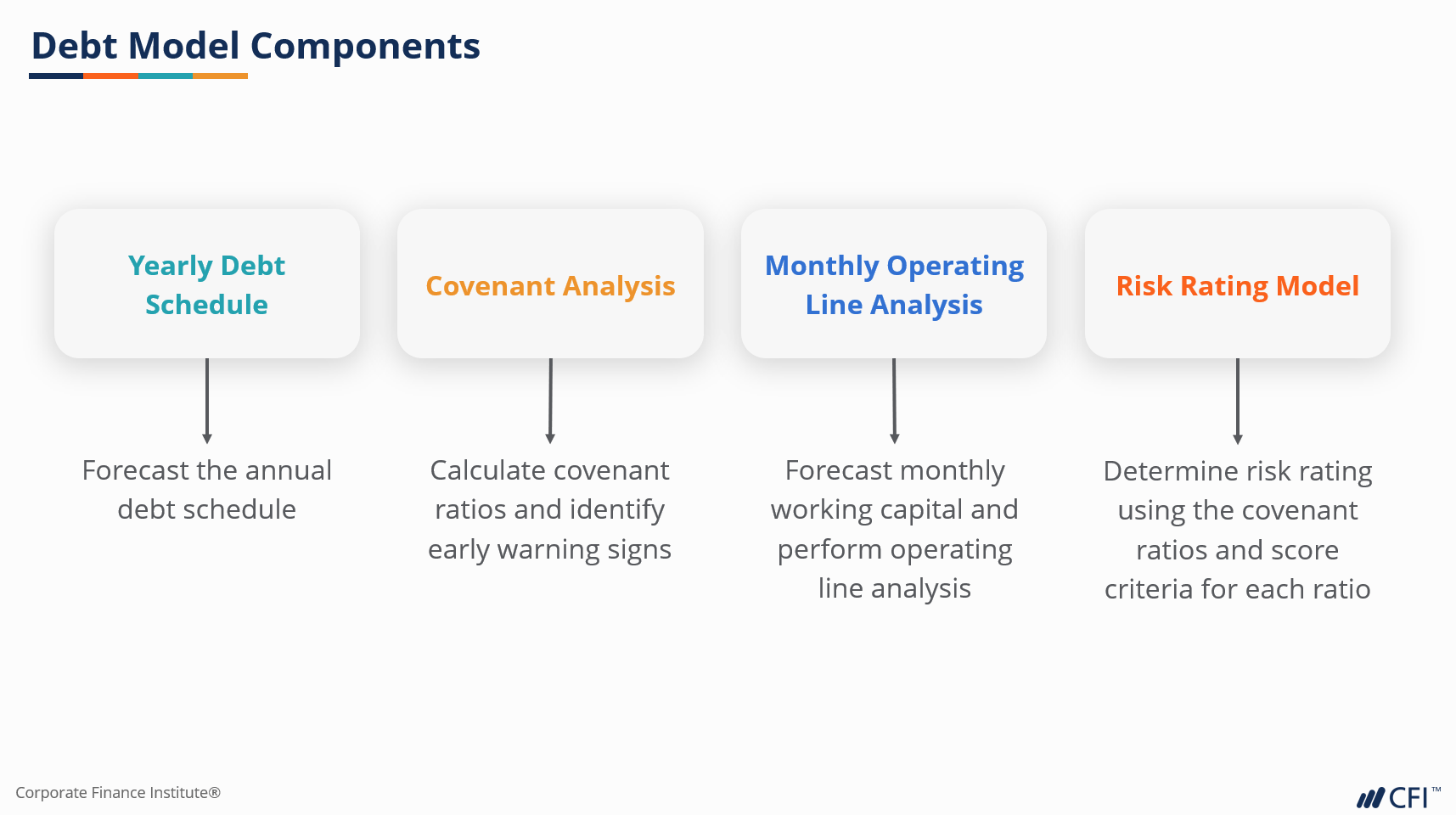

This course covers the key components of building a debt model commonly used by commercial banks in assessing a borrower’s cash flows and performing covenant analysis. In this course, we will discuss the differences between operating finance (operating line of credit) and term lending (term loans). We will walk through the major components of a debt model, including the yearly debt schedules, covenant analysis, monthly operating line analysis, and a quick overview of a risk rating model. By the end of this course, you should be able to construct a fully-linked debt model which entails the cash flow forecast of a borrower, its debt capacity, the impact of cash sweep, and any early warning signs of a covenant breach.

Who should take this course?

This Commercial Banking – Debt Modeling course is perfect for any aspiring credit analysts working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation. It is also a great elective course for anyone who would like to learn more about how commercial banks forecast the debt capacity and cash flows of borrowers.

Commercial Banking - Debt Modeling Learning Objectives

- Differentiate between operating finance (operating line of credit) and term lending (term loans)

- Understand the benefits of using different types of credit facilities

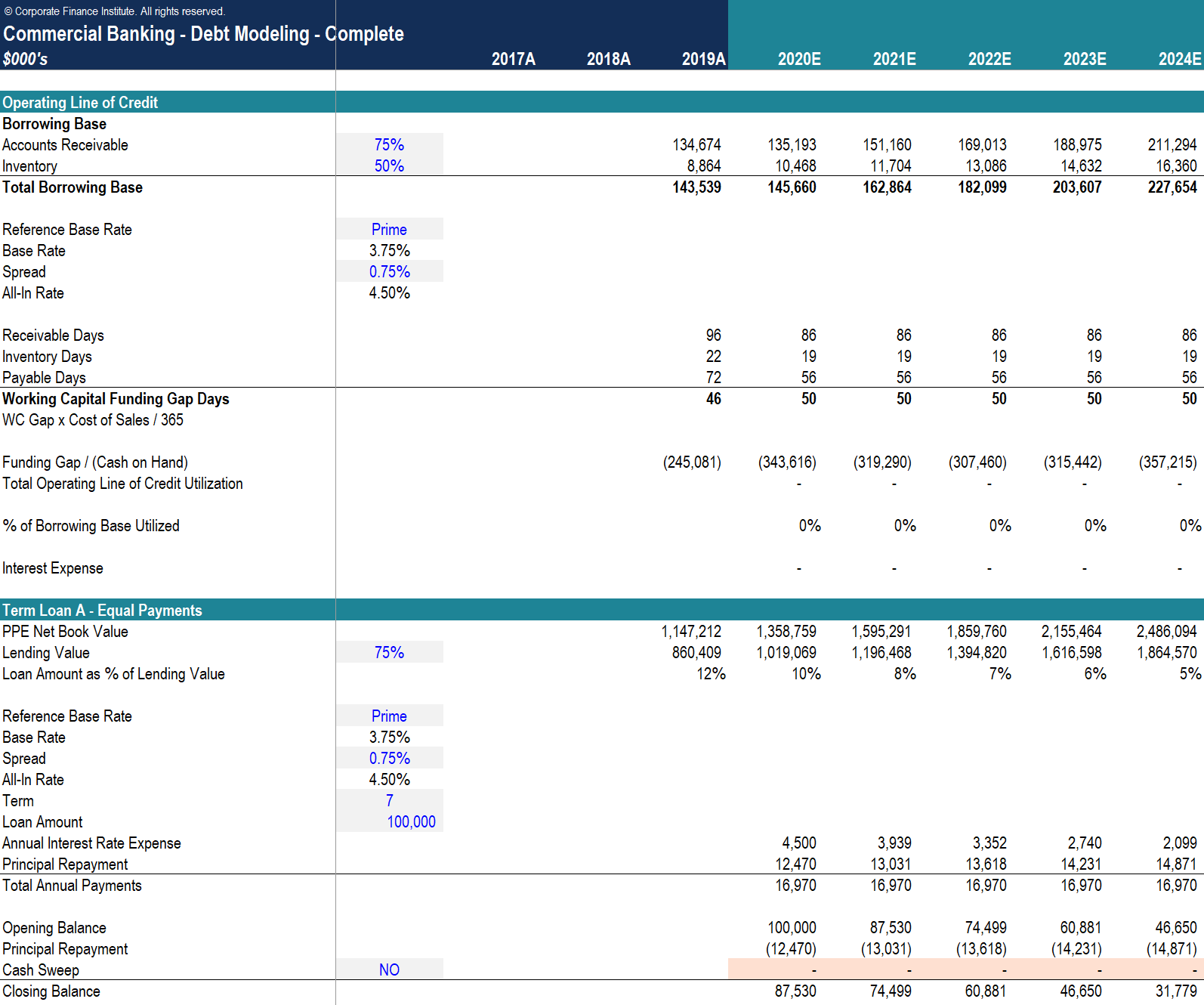

- Build a yearly-debt schedule laying out the different types of debt drawn, the interest expense, and the principal repayments

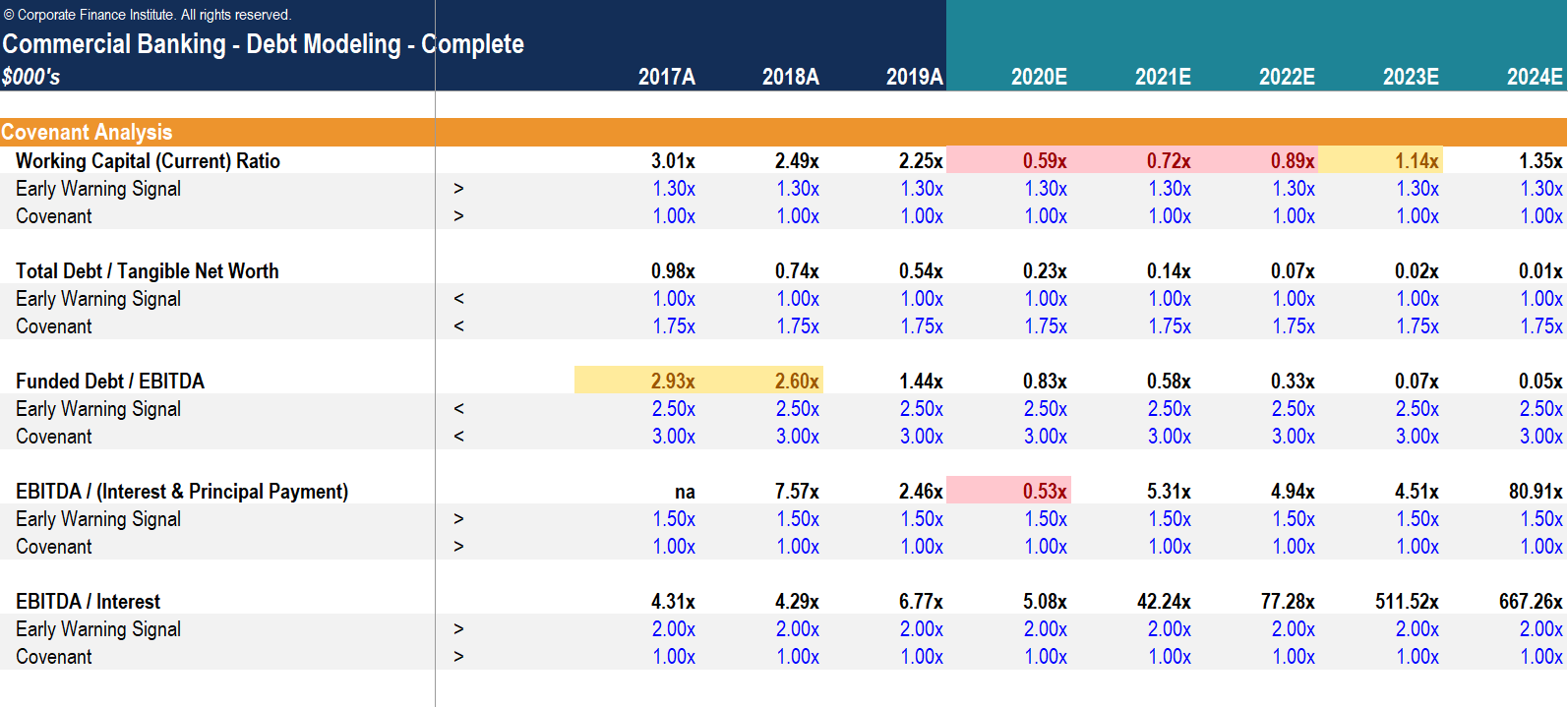

- Perform covenant analysis to identify early warning signs and possibilities of breach

- Construct a monthly operating line analysis to determine the operating line drawn and the amount available based on margining

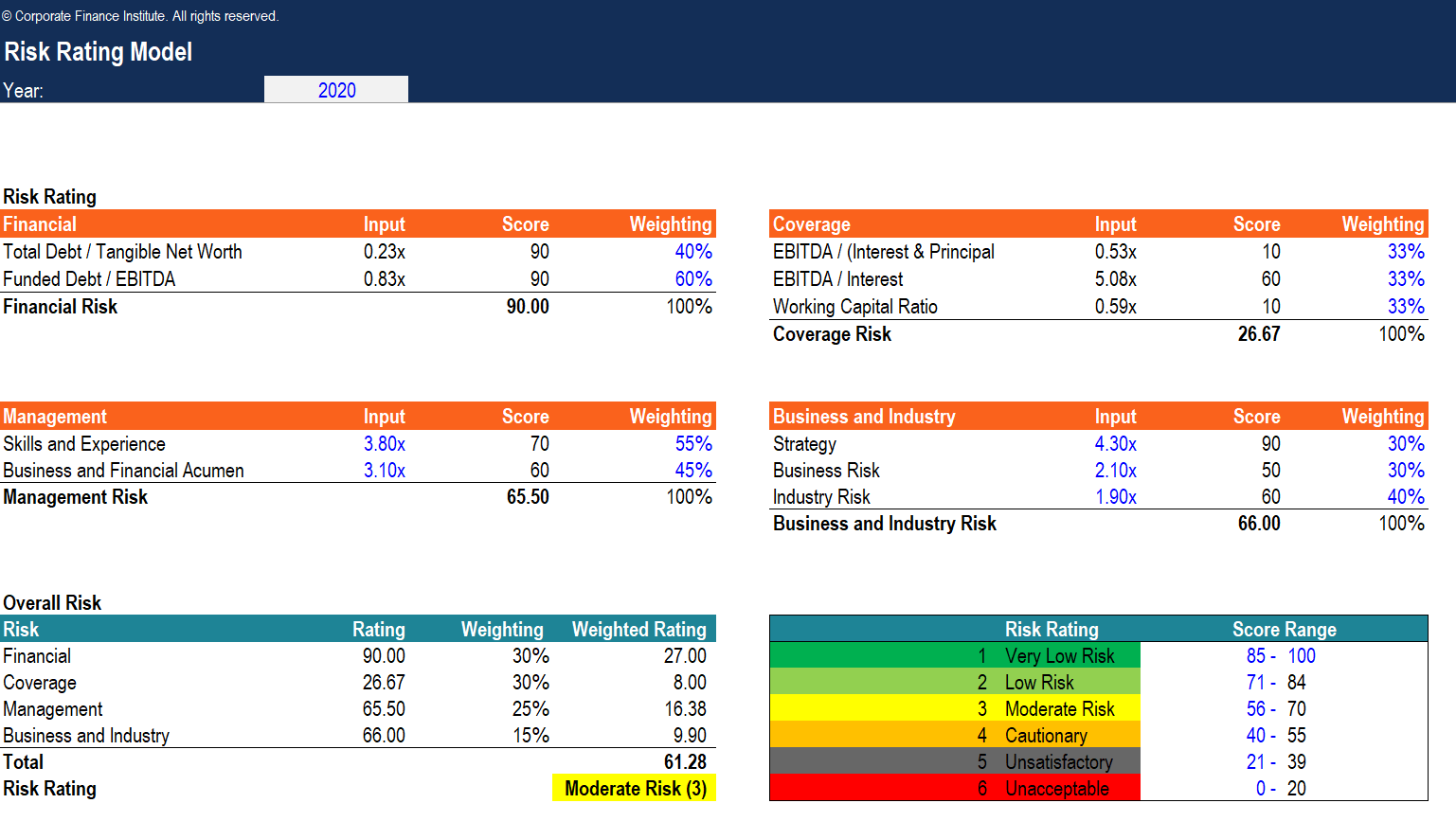

- Understand how the amount of leverage could impact a company’s risk rating

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

- Financial modelling

- Basic data analysis

Level 4

1h 44min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Introduction

Constructing the Debt Model

Yearly Debt Schedules

Monthly Operating Line Analysis

Risk Rating Model

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending