Overview

Careers in Commercial Banking course overview

This Careers in Commercial Banking course offers a comprehensive overview of the different roles and opportunities available in the commercial banking industry. You will learn about each role’s function and responsibilities, as well as what a typical day-in-the-life looks like for each position. Additionally, you will gain practical and nuanced knowledge, as this course helps you identify role-fits based on the experience, technical skills, and personality traits responsible for driving success in each position. Lastly, the course empowers you with the information you need to ensure that your career research is focused and will be a valuable resource when preparing for the commercial banking recruiting process. After completing this course, you will have a better understanding of how a commercial bank is structured, as well as a real-world perspective of what the different roles in a commercial bank entail and the traits needed to succeed in each respective position.

Who should take this course?

This Careers in Commercial Banking course is designed for anyone interested in pursuing a career in banking. Whether you are about to start your first job search as a new graduate from an academic institution, or you are ready to transition careers paths after gaining professional experience in a different field, this course will help you develop a comprehensive understanding of the careers available to you and will serve as a valuable guide to anyone looking to learn more about the banking sector.Careers in Commercial Banking Learning Objectives

- Explain the core functions and purpose of a commercial bank

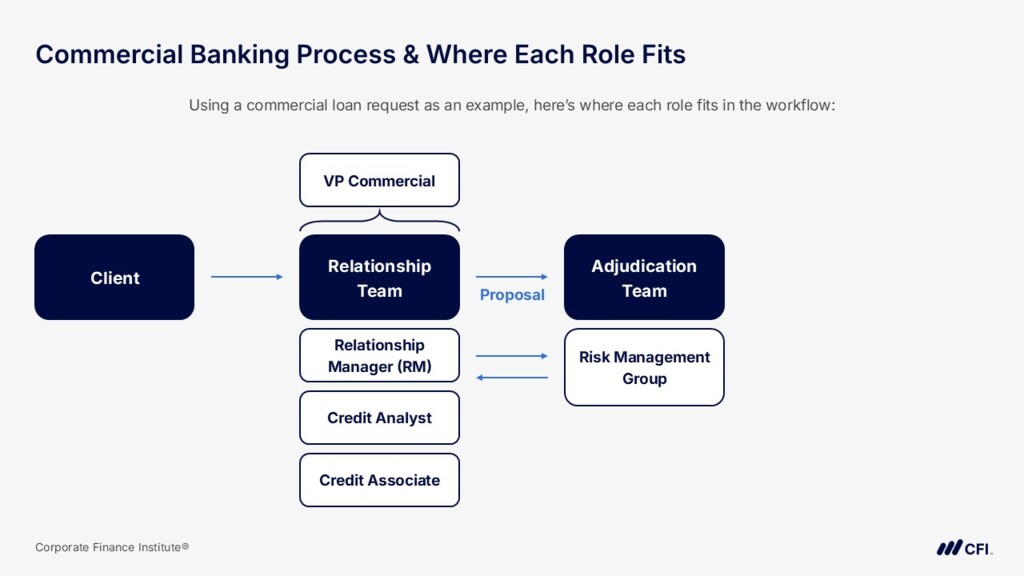

- Differentiate among the major roles and divisions within commercial banking

- Identify key factors to consider when evaluating potential career paths

- Assess your personal fit for specific roles by applying technical, behavioral, and personality criteria

- Describe how roles work

together to support the

recruiting and interview

process

Prerequisite Skills

Recommended skills to have before taking this course.

- Logical thinking

Level 1

52min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Summary

Conclusion

Qualified Assessments

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending