Overview

This Asset-Based Lending & Alternative Finance course dives into lending solutions for borrowers that don’t fit the target profile of a more traditional senior lender, like a commercial bank. Despite falling short of these requirements, many companies are still attractive borrowing prospects for alternative finance firms. This course shows how lenders assess these unique opportunities and structure non-standard credit by leveraging balance sheet assets as collateral to support riskier borrowers. We will also examine the differences between these solutions and more traditional forms of commercial financing.

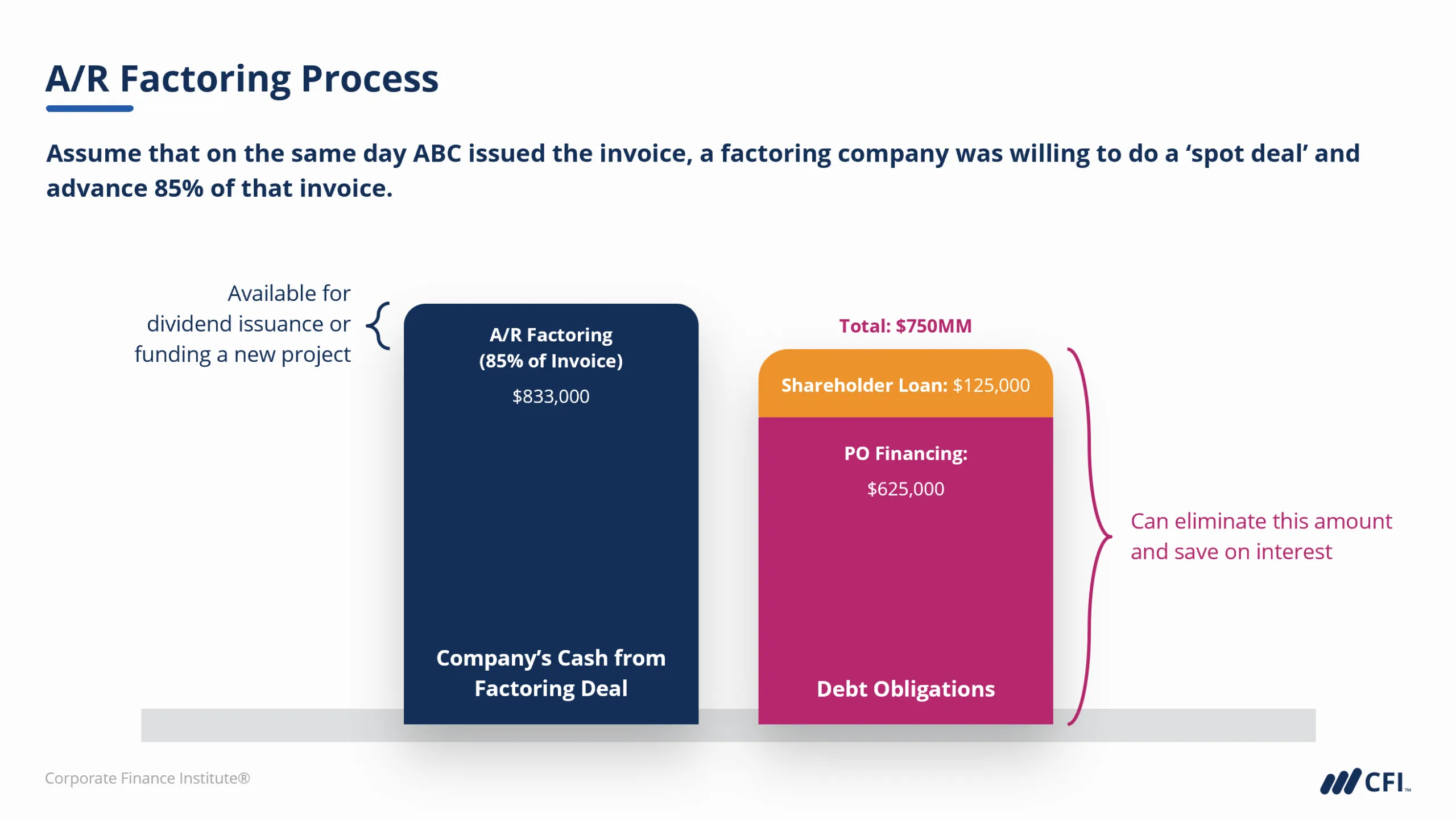

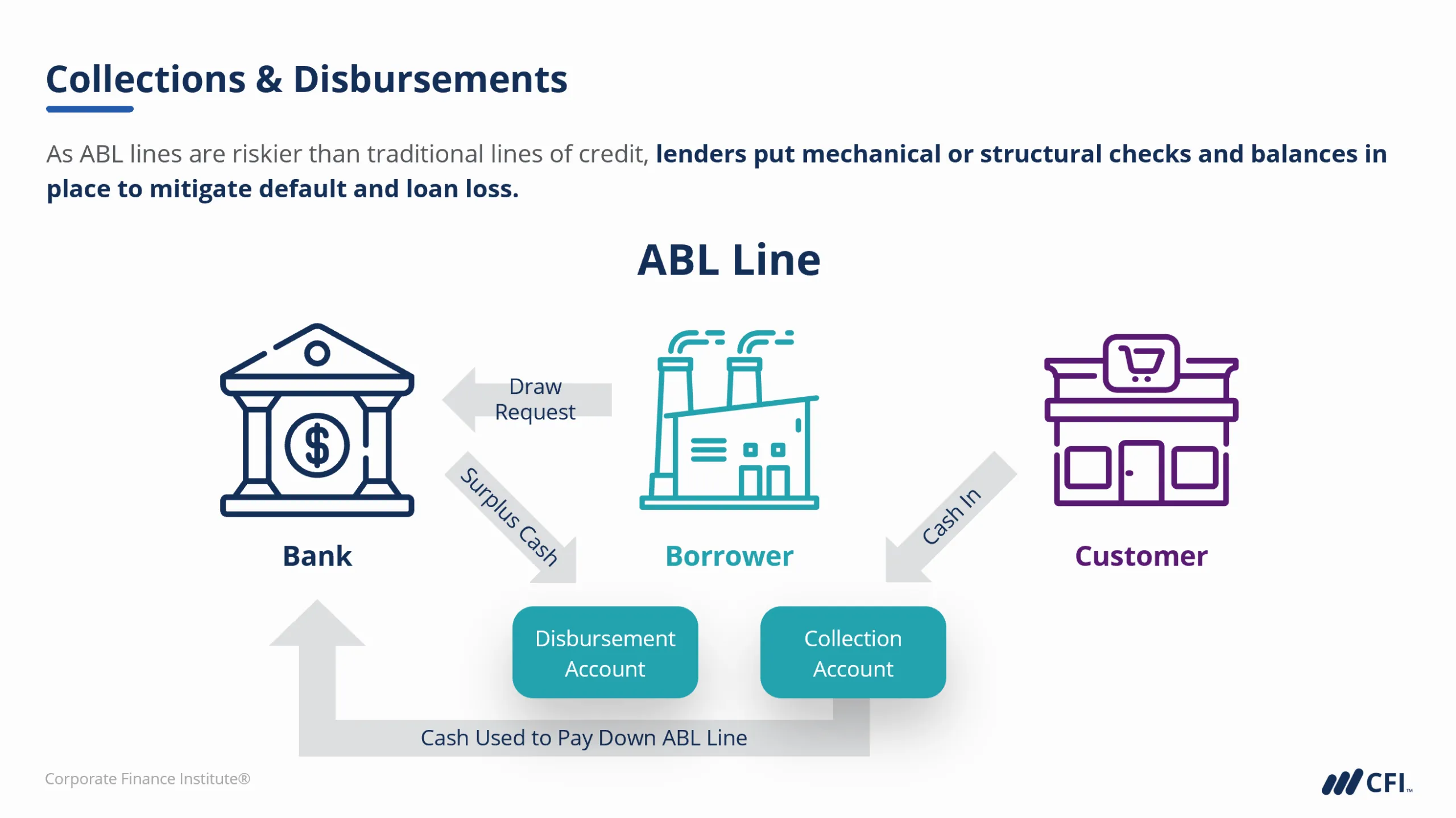

The lending solutions we will be looking at in this course are: purchase order financing (PO financing), accounts receivable factoring (A/R factoring), asset-based lending lines (ABL lines), and sale-and-leasebacks.

Who Should Take This Course?

This Asset-Based Lending & Alternative Finance course is suited for current and aspiring commercial lending professionals and credit analysts. Commercial bankers and analysts can work for many different types of financial institutions. It is important to understand the tools available for any type of lender to provide value to their borrowers. This course will prepare you with the knowledge you need to identify and apply these alternative financing tools and strategies.

Asset-Based Lending & Alternative Finance Learning Objectives

- Compare alternative lending structures, including purchase order financing, accounts receivable factoring, asset-based lending (ABL) lines, and sale-and-leaseback transactions

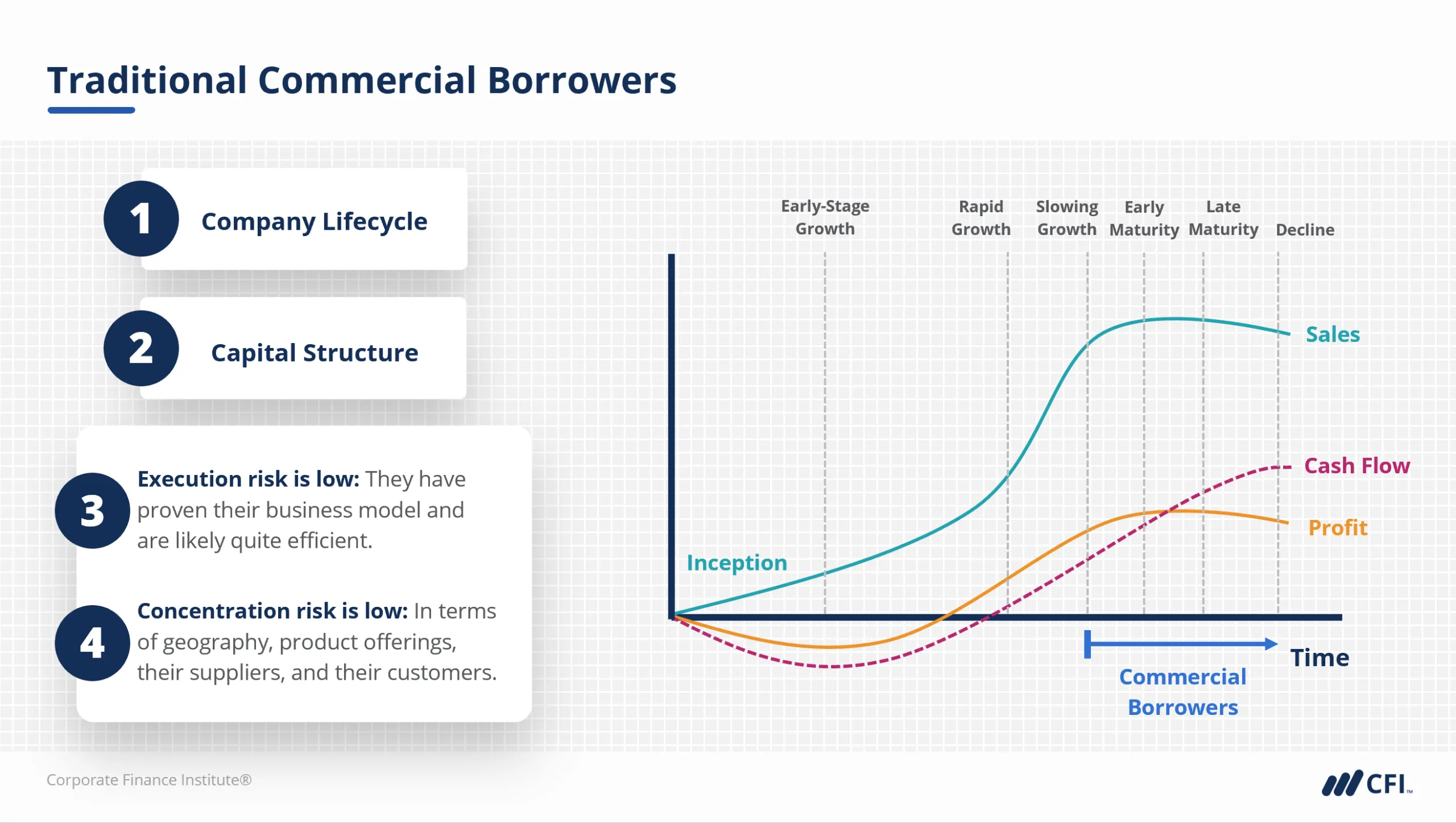

- Differentiate between asset-based lending solutions and more traditional forms of commercial financing—like operating lines of credit

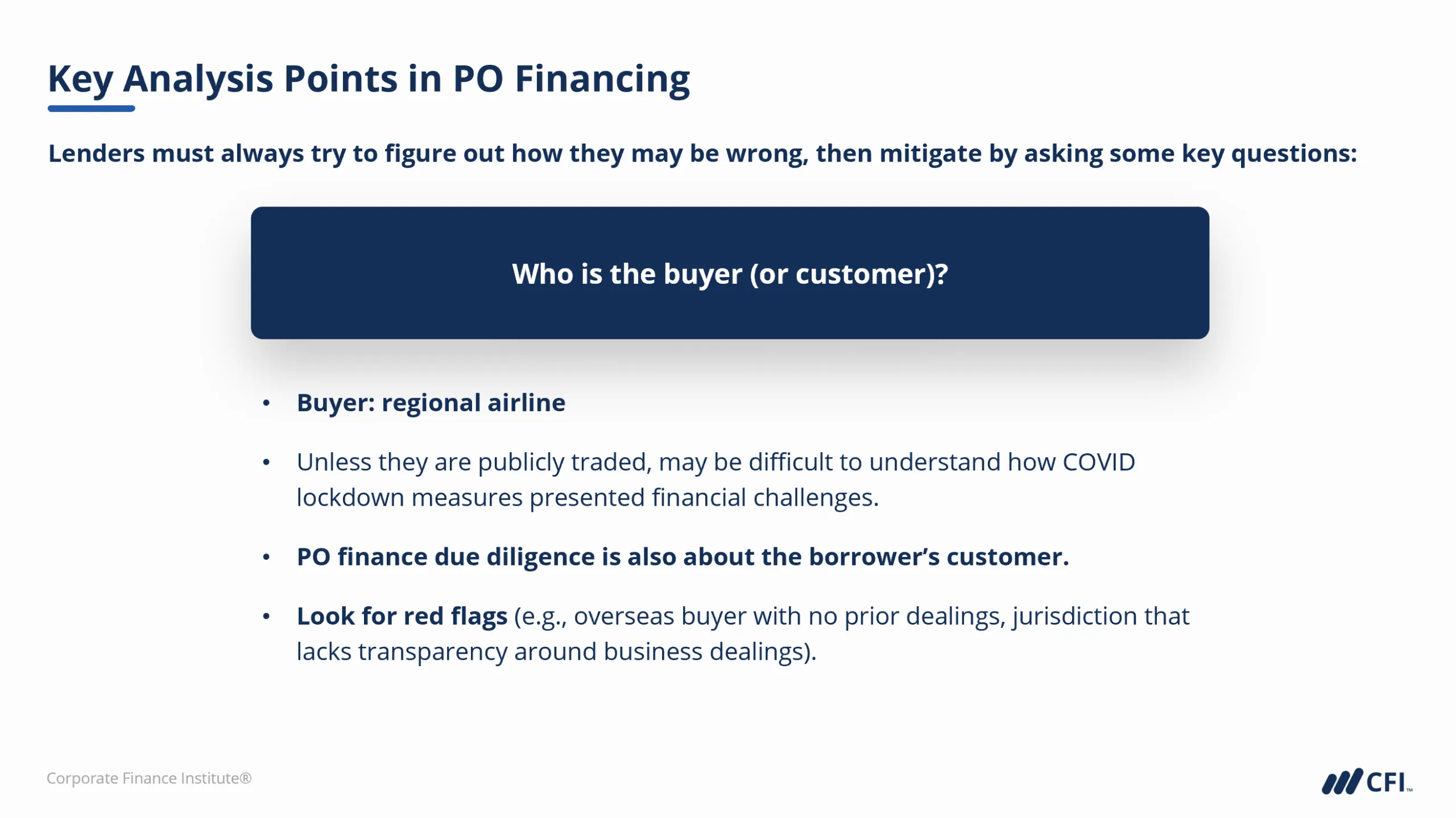

- Analyze the underlying causes of weak or deteriorating risk ratings and identify when a good lending opportunity may still exist

- Calculate credit needs for various borrowing scenarios

- Recommend the most appropriate lending solution based on important client characteristics like business type, lifecycle, and capital structure

Prerequisite Courses

Recommended courses to complete before taking this course.

Level 4

1h 51min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Purchase Order Financing

Asset-Based Lending Line

Conclusion

Qualified Assessments

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending