Overview

Assessing Drivers of Business Growth Overview

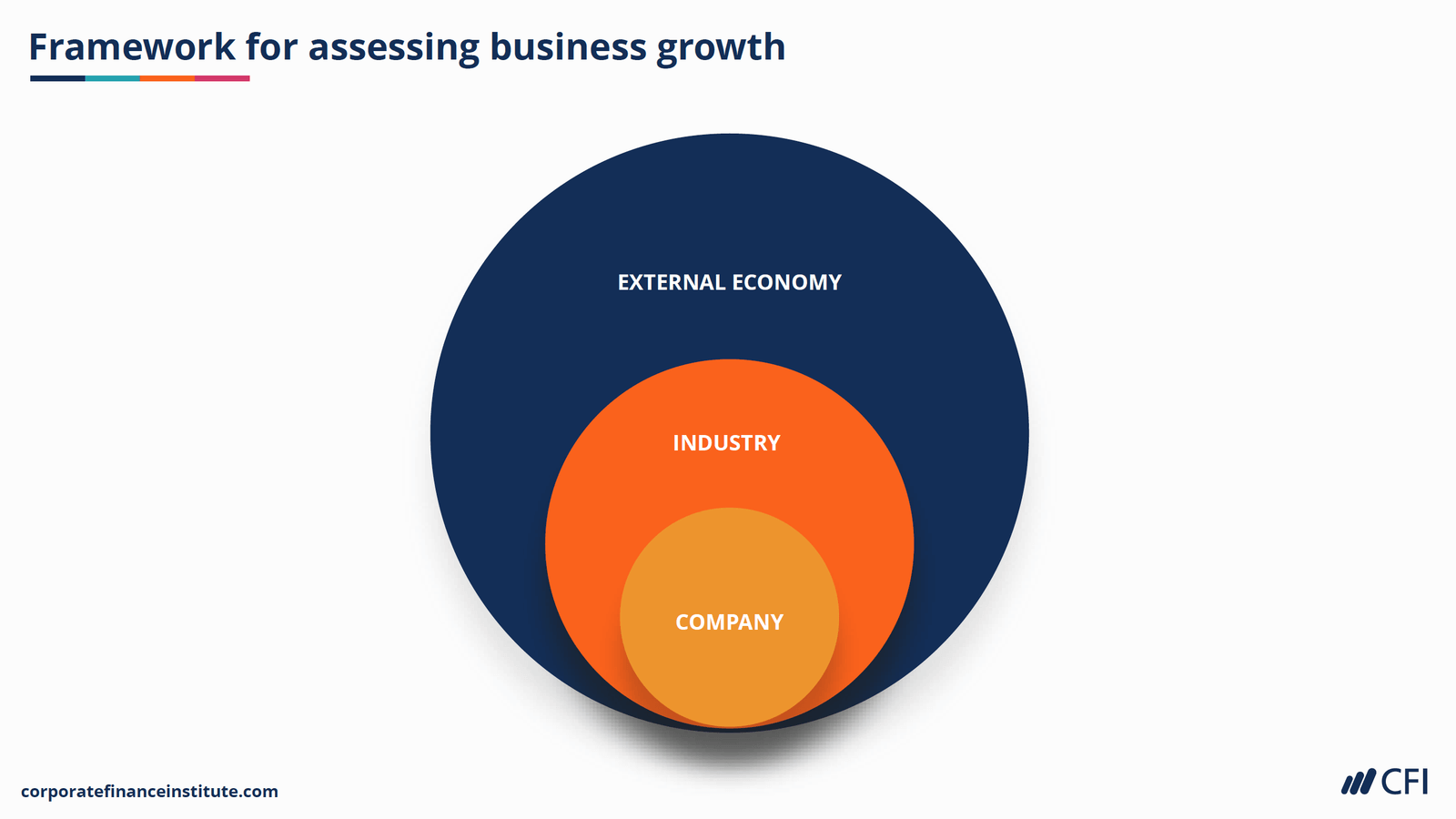

Understanding the key drivers of a business’s growth is vital to determining its debt capacity and ability to fulfill debt with its cash flows. This helps credit analysts make sound credit decisions. This Assessing Drivers of Business Growth course will look at the overall framework for assessing business growth, including analyzing the external economy, the industry, and the company itself. We will explore the commonly used tools by credit analysts to perform analyses on various aspects of a company and summarize the external and internal factors impacting the business’ growth. By the end of this course, you should feel comfortable determining whether a company is in good operational or financial condition.

We will explore the commonly used tools by credit analysts to perform analyses on various aspects of a company and summarize the external and internal factors impacting the business’ growth. By the end of this course, you should feel comfortable determining whether a company is in good operational or financial condition.

Who should take this course?

This Assessing Drivers of Business Growth course is perfect for any aspiring credit analysts working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation.Assessing Drivers of Business Growth Learning Objectives

- Understand the framework for assessing corporate business growth

- Analyze the external economy that a company operates in using PESTEL analysis

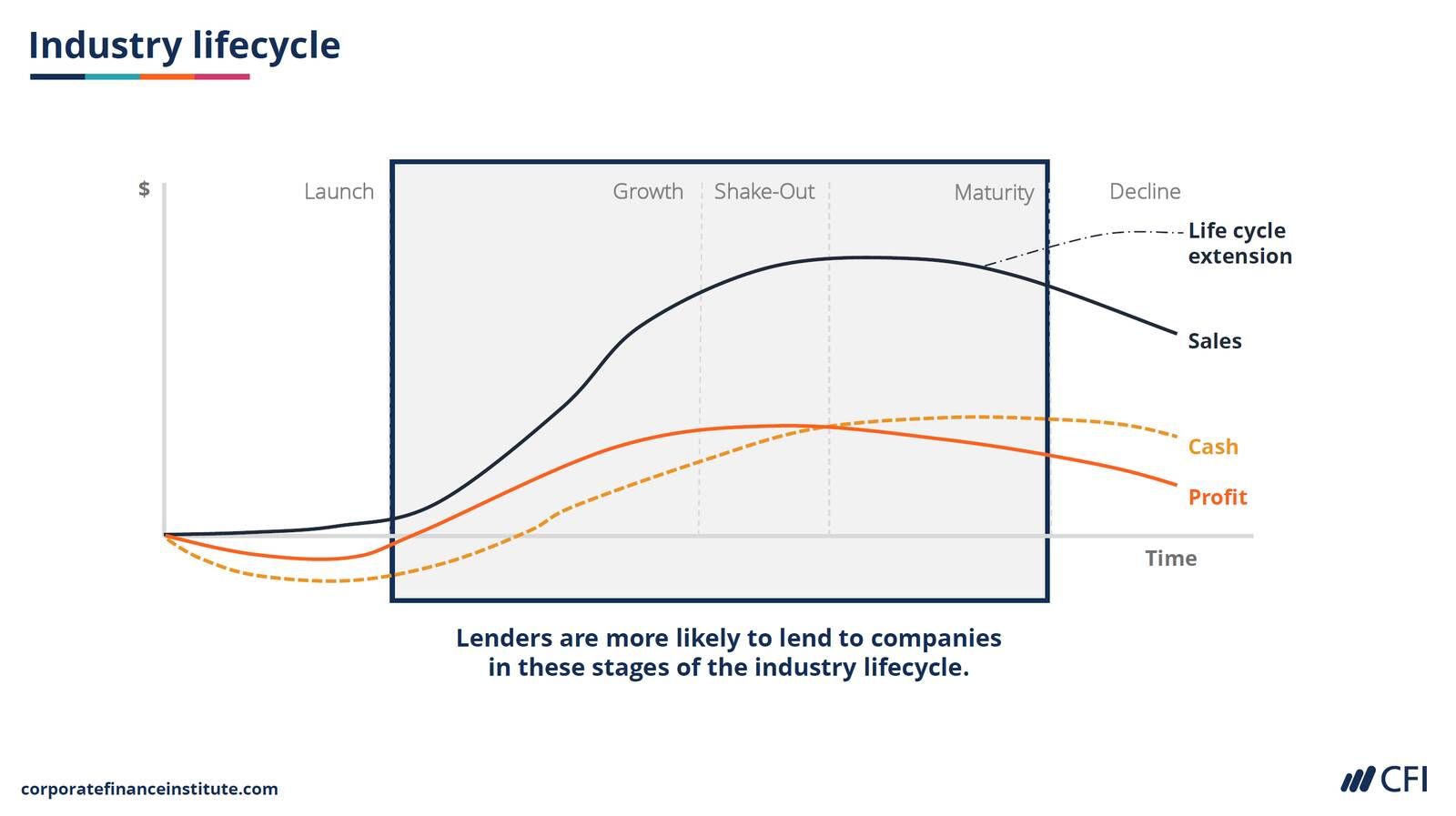

- Analyze a company's industry by looking at Porter's five forces and the industry lifecycle

- Assess a company's lifecycle, risks, and competitive advantage

- Perform SWOT analysis to evaluate a company's internal and external environment

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

- Logical thinking

- Basic computer skills

Level 2

45min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Analyzing the External Economy

Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending

Financial Planning & Wealth Management Professional (FPWMP®) Certification

- Skills Learned Financial Learning, Business Development, Investment Management, Practice Management, Relationship Management

- Career Prep Financial Planner, Investment Advisor, Portfolio Manager