Overview

Account Monitoring and Warning Signs Overview

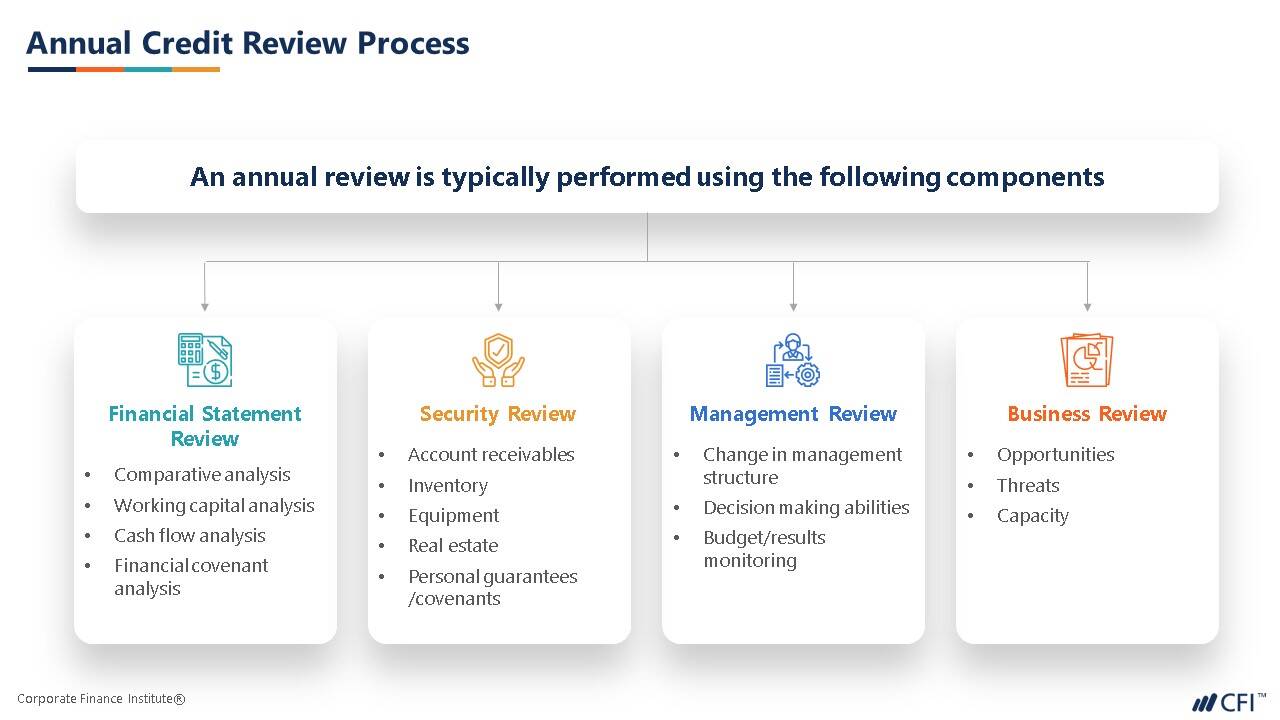

Looking to explore a career as a credit analyst? The Account Monitoring and Warning Signs course will teach you the symptoms and causes of corporate decline, how to predict the default risk for a company, different methods for handling problematic accounts (clients who are struggling to repay loans), and more. This course starts with the warning signs for a company that is experiencing financial difficulties, as well as the typical symptoms and causes of corporate decline. It then dives into Altman’s Z-score and how it can be used to assess the credit risk of a company.

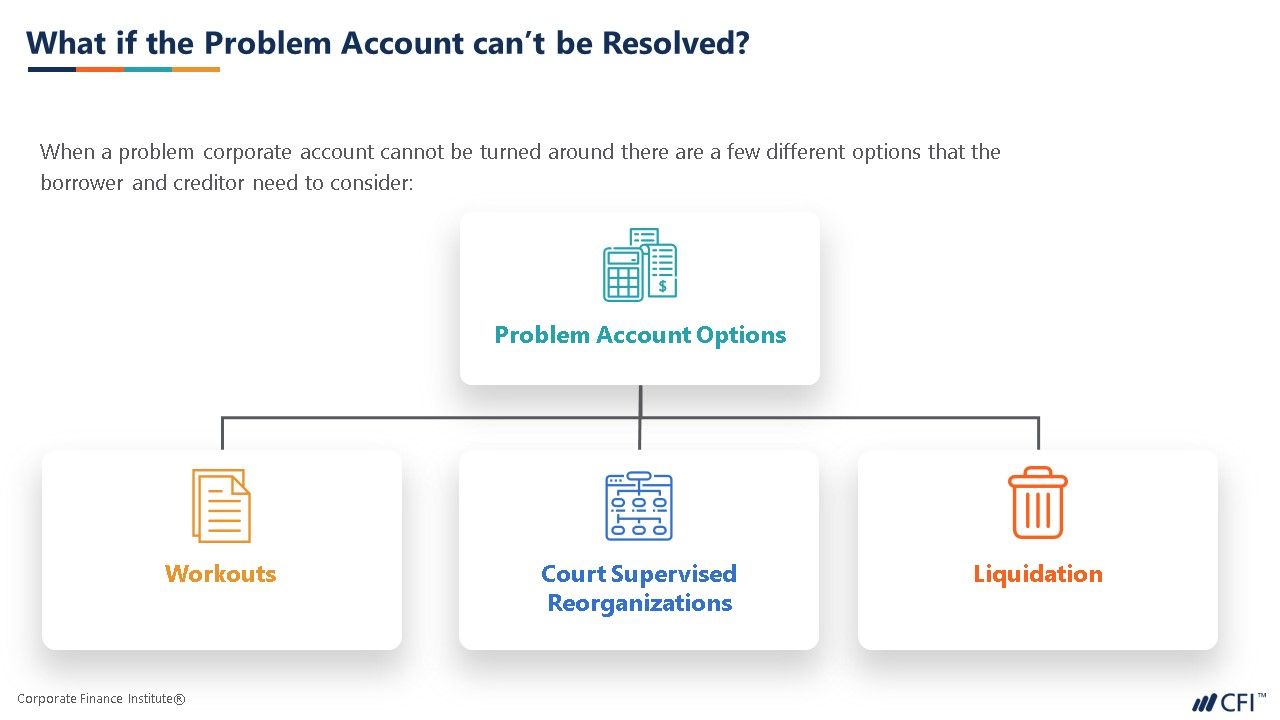

Afterward, the default risk of a firm is predicted through different methods including options theory and the Expected Default Frequency (EDF) model. After assessing the likelihood of default, the course explores different strategies and tactics used to deal with deteriorating accounts, including the steps for developing an action plan and turning around a declining business.

This course starts with the warning signs for a company that is experiencing financial difficulties, as well as the typical symptoms and causes of corporate decline. It then dives into Altman’s Z-score and how it can be used to assess the credit risk of a company.

Afterward, the default risk of a firm is predicted through different methods including options theory and the Expected Default Frequency (EDF) model. After assessing the likelihood of default, the course explores different strategies and tactics used to deal with deteriorating accounts, including the steps for developing an action plan and turning around a declining business.

This course is great for someone looking to enhance their ability to anticipate corporate decline, assess the credit risk of current companies, and understand how to implement strategies to improve a company’s weakening performance.

This course is great for someone looking to enhance their ability to anticipate corporate decline, assess the credit risk of current companies, and understand how to implement strategies to improve a company’s weakening performance.

Who should take this course?

This Account Monitoring and Warning Signs course is perfect for any aspiring credit analyst working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation.Account Monitoring and Warning Signs Learning Objectives

- Identify and understand symptoms and causes of corporate decline

- Evaluate the drivers behind predicting default and credit risk

- Examine the various methods for handling problematic accounts

- Implement key turnaround strategies depending on the growth stage of the company

Prerequisite Skills

Recommended skills to have before taking this course.

- Critical thinking

- Basic Math

- Basic statistics

Level 3

54min

100% online and self-paced

Field of Study: Finance

Start LearningWhat You'll Learn

Identifying Warning Signs

Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending